If you’ve been following the grain markets for the last year or two, you’ve definitely seen that they’ve been on a wide ride. On August of 2020, the nearby active corn contract opened at $3.15/bu. Almost a year and a half later in April of 2022, the nearby active corn contract opened at $7.48/bu – over a 100% increase.

In between those two periods we saw a midwest derreco, a land war in europe break out, poor US production, and a host of other concerns that have caused market volatility to skyrocket.

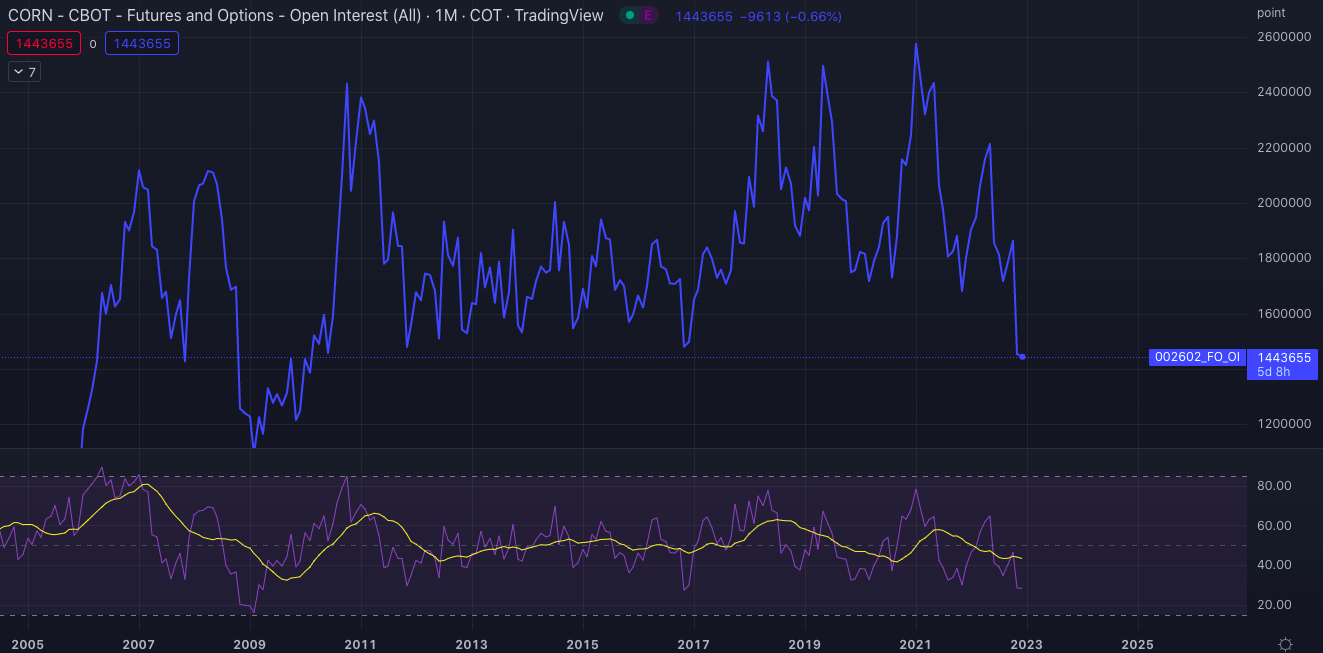

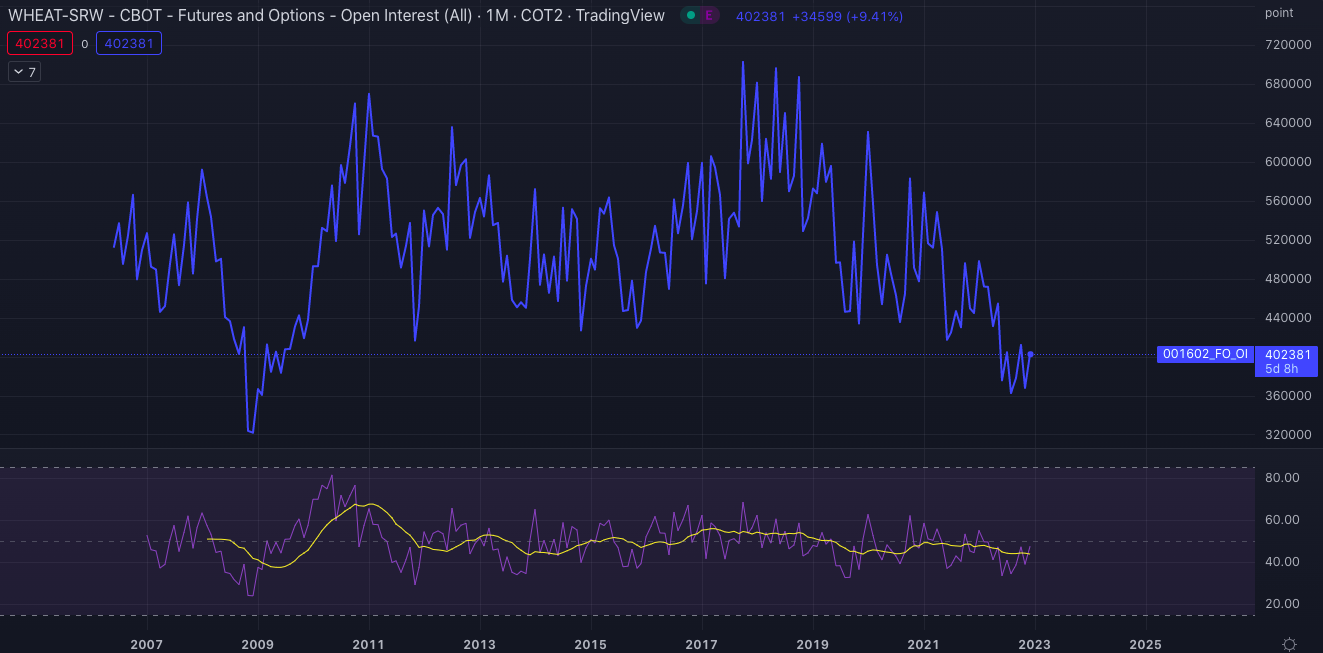

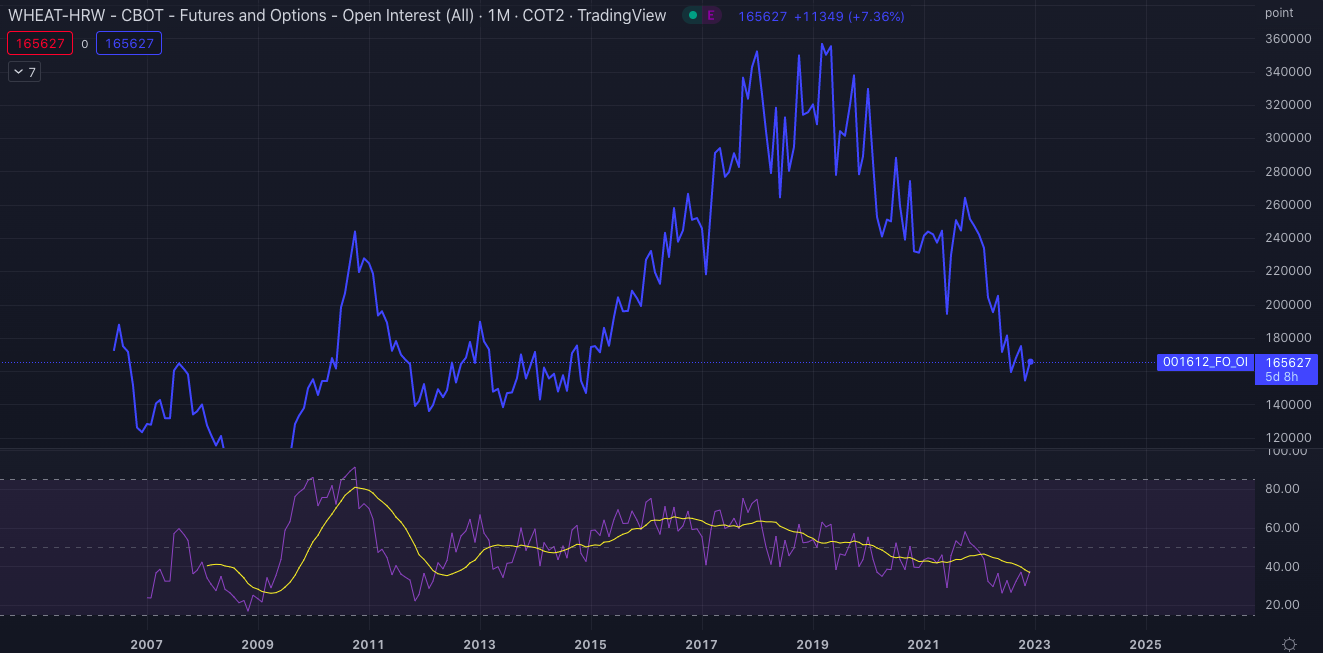

Along with higher prices and higher overall volatility we have also seen grain open interest decline meaningfully. The decline in open interest is almost certainly caused to some extent by a lack of clarity in market direction. This lack of direction causes funds and other market participants to head to the sidelines instead of holding onto active positions. At the same time, end users will tend to be a bit shorter than they otherwise would while the try to “weather the storm” of higher prices and producers should be a bit longer than they otherwise would be as they try to lock in profit margins.

All of this combined leads to markets that tend to have widers bid ask spreads, larger daily ranges, and an overall decline in trading market conditions.

Let’s take a look at a few popular grain open interest (OI) in particular to see how they are trending relative to their history:

Corn OI

Current corn open interest levels are as bad as they’ve been since February 2010.

CBOT Wheat OI

CBOT wheat open interest levels are as bad as they’ve been since July of 2009.

KC Wheat OI

KC Wheat open interest levels are as bad as they’ve been since January of 2015.

What will Cause Open Interest to Increase?

Will open interest levels remain depressed forever? Probably not. Ultimately, the decline in open interest is a sign of the times and will likely begin to increase again as more certainty comes back to the markets. In the meantime, all market participants can do is stick to their predetermined risk management plans.