The problem with most risk management and hedging programs today is that there is a lack of a defined process. Too many producers and consumers are either trying to buy the absolute top/bottom, getting nervous and buying/selling on impulses, or simply buying to a budget.

From a risk management perspective, all of these strategies will almost certainly result in failure. The reasons for this are below:

- If you could time the market, you would be sitting on a beach somewhere, not working. There is not a sole on this earth that can consistently time the market.

- Markets are impulsive, if you get nervous and buy/sell you do not have a plan that you are following. It is widely known and accepted that markets overshoot highs/lows and chances are that is when you will be buying/selling

- If you are buying to a budget, you are not considering supply and demand. Buying to a budget works in some instances, but not in others. What if the market never gets to your budget? what if your budget is too high/low? Additionally, buying to a budget can leave you uncompetitive relative to others in your industry.

So, what do you do?

Put simply, you develop a plan of action, and you follow it. I have spent years developing a systematic approach to risk management that consistently allows me to sell above, or buy below, the average market price for a given time period. Sound too good to be true? It’s not.

We developed a program to time the majority of your buying/selling based on seasonal trends of the market. At the same time, we developed a systematic market indicator to give buy and sell signals based on various momentum and fundamental variables.

To provide a bit more context, below is an example using December 2022 Chicago Wheat.

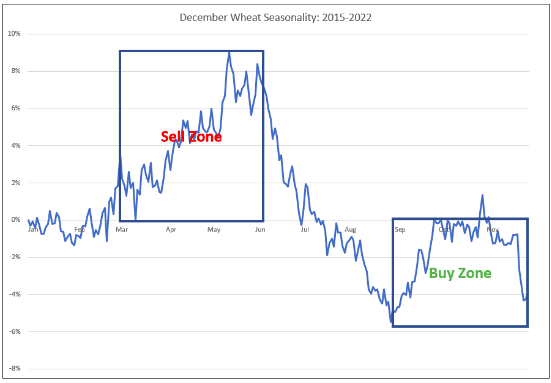

Seasonal Timing:

It’s no secret that commodity markets follow seasonal trends. Prices tend to be lowest just after harvest and slowly increase until supplies are replenished. Why not use this to our advantage? Letting seasonality guide the bulk of our buys and sells is exactly what the market tells you to do – don’t fight the market.

Putting this into practice:

- Producers should sell the majority of their crops in the “Sell Zone”

- Consumers should buy the majority of their needs in the “Buy Zone”

When we say “buy/sell the majority of their crops/needs,” there is obviously no right answer to this statement. Each producer and consumer has different levels of risk tolerance and needs. When we work with customers, we develop a strategy that teases out those details so that they are able to effectively develop a plan. What seems to be the case for most, however, is that about 60% of annual requirements – be it old crop, or annual purchases – should be managed in the buy/sell window while the remaining 40% should be managed outside of the seasonal zones.

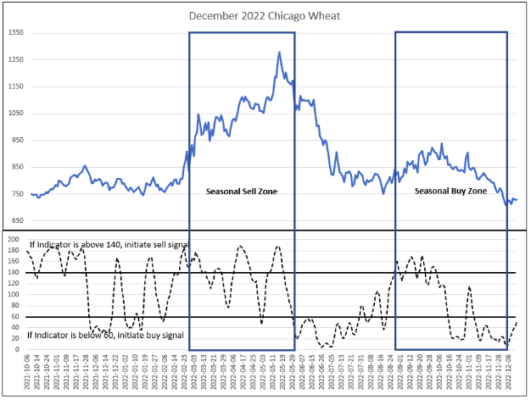

Systematic Indicator:

Now that we have seasonality taken into consideration, I need to incorporate my proprietary systematic indicator. This indicator is something we built after years of tinkering with data and being involved with the markets. It produces buy and sell signals based on a few momentum indicators – basically looking at the speed of price changes over a given period of time.

Below is our actual indicator performance against the December 2022 Chicago Wheat contract.

To make sense of the indicator rules:

- If the indicator produces a reading above 140, it is considered an active sell signal

- If the indicator produces a reading below 60, it is considered an active buy signal

- These buy and sell signals can last for multiple days and are meant to simply give you awareness that the markets are likely at a favorable level to initiate coverage

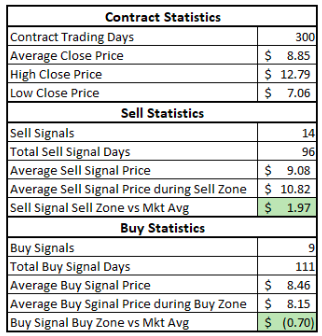

Results:

Testing risk management and hedging strategies are notoriously hard. What are you benchmarking against? What tools did you use? To weed out all of that noise, we benchmark our strategy against the contract average price for the period we are looking at. Below are the statistics against the December 2022 Chicago Wheat contract.

In one of the most volatile wheat markets in the last 20+ years, our systematic approach to hedging, when combined with seasonal market tendencies provided a better price for both buyers and sellers than the market average allowed.