Producer Risk Management Theory

Successful risk management for commodity producers tends to focus primarily on protecting prices that are at or above the cost of production while removing volatility, providing margin enhancement opportunities, and providing predictability for the underlying business.

The way that has traditionally been accomplished is for producers to make forward sales against their anticipated production before, during, or after the growing season. These forward sales can be made using several different tool, timeframes, and pricing components.

Sounds easy, right? It’s incredibly difficult. These sales decisions have a material impact on the producers bottom line and if not done correctly, can result in very little, or no, profit in some years.

Let’s unpack exactly how producer risk management theory says hedging should be done. For simplicity’s sake, I will only be focused on futures and options here and will not focus on basis markets. Those are another discussion entirely.

Determining Exposure, Production Cost, and Duration

One of the most challenging components for producers is knowing what their true exposure is and what their production costs are. Think about it, from a producer’s perspective both their exposure and their production costs depend on their final yield, which greatly depends on the weather during the growing season. The growing season is seasonally when producers should be making their forward sales as it tends to be the time of the year when prices are highest.

To make matters even worse, there is an inverse correlation between yield and prices. What this means is that at times when yields are high and producers are flush with grain to sell, prices will be low. On the opposite side, when yields are low and grain is sparce, prices will be high.

How do producers overcome this yield conundrum?

Typically, producers will use historical average production levels to get an expectation for yields. This is not a foolproof method as droughts, etc. can still impact yield and production, but it does help provide some guideposts.

Once a yield estimate is made, producers can use that yield estimate to estimate their per bushel production cost. To get to a per bushel cost of production, producers take their per acre cost of production and divide that by their estimated yield.

As an example, if a producer has an estimated production cost of $740 per acre and an estimated yield of 200 bushels per acre, their estimated cost of production is $3.70/bu.

Once a producer has their estimated yield and their cost of production, they ca

Choosing the right tool for the Right Market Conditions

Once you have a good idea of what your pricing window is, you can then weave market conditions into the equation. The most effective and consistent way of achieving this is to let pricing percentiles guide whether you are using futures, options, OTC products, or any combination of the like.

Let’s look at an example:

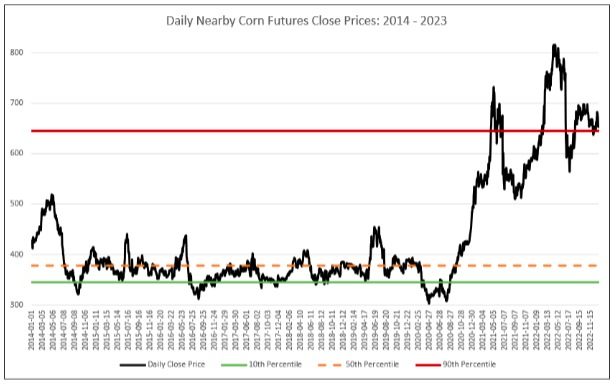

Above is a chart of nearby corn futures from January 2014 to January 2023 with the 10th, 50th, and 90th percentiles all plotted on the chart.

Looking at things from this perspective, it is easy to see that when prices are in the 90th percentile over a given time period, you probably need firm downside protection, but not much further upside opportunity. What’s an effective way to execute that? Selling futures.

Likewise, when markets are in their 10th percentile over a given time period, producers probably need some upside recovery if prices rally. How do you achieve this? Options.

Letting your pricing window guide your duration and market conditions guide your tools allows for effective risk management.

Repeatable Coverage Decision

Once producers have determined their exposure, production costs, pricing window (i.e. duration) and the market conditions (i.e. tools), the final step they need to take is to develop and implement a process for repeatable coverage decisions.

Far too often, producers try to pick market tops or bottoms and “nail the market.” The problem with this is that it’s impossible. There are simply too many variables to consider to make it repeatable. If anyone could get it right, even 50% of the time, they would be sitting on a beach drinking Corona and not working.

Some companies realize this issue and take the exact opposite approach of trying to time the market. These companies simply direct employees to buy along the forward curve at predetermined intervals, creating weighted average coverage. The problem with this? You become a complete price taker. If you are simply buying one week at month, using one tool type, and not considering market inputs you have given away all of your control.

So, how do you get around this?

Someone, or something, has to make a decision to buy, so what do you do?

The short answer is that producers need to build out a repeatable process that works under varying market conditions. For me, this is where my systematic indicators and targets come into play.

My systematic indicator is one that I have built over the years and looks for extreme levels of overbought and oversold levels in the market. It uses these levels to make recommendations whether it is a good opportunity to buy or sell. The idea to is take the guesswork out of the markets, make the process repeatable, and to sustainably buy below the 50th percentile, or sell above the 50th percentile for any given market for any given time.

If you are interested in seeing the back testing of my systematic hedge model, click here.

To supplement my model, I also look at the options market for target levels. The options market, via implied volatility, is very good at identifying target levels for expected coverage. This again takes the guesswork out of the markets and makes the process repeatable.

Ongoing Position Maintenance

Finally, once producers have determined their exposure, production cost, duration, chosen the right tools, and executed coverage; they need to conduct ongoing maintenance via pre and post analysis.

The pre analysis, as I call it, is regularly looking at your hedges to understand whether they are still working for your business or operation. You execute hedges based on current market conditions and understanding. Those conditions and understanding change through time, so your hedges might need to as well.

The post analysis, as I call it, is after your hedges have run your course. This is a lookback and growth opportunity where you analyze your hedges to see what worked, what didn’t work, and what could be improved upon.

Read more about my Systematic Buy and Sell Model here.