Get in Touch

Interested in learning more about my risk management process or my systematic hedging model? Send me a quick note, I’ll get back to you soon.

The problem with most risk management and hedging programs today is that there is a lack of a defined process. Too many producers and consumers are either trying to buy the absolute top/bottom of a market, getting nervous and buying/selling on impulses, or simply buying to a budget.

From a risk management perspective, all these strategies will almost certainly result in failure over time. The primary reasons for this are below:

If you could time the market, you would be sitting on a beach somewhere, not working. There is not a soul on this earth that can consistently time the market.

Markets are impulsive, if you get nervous and buy/sell or those nerves you do not have a plan that you are following. It is widely known and accepted that markets overshoot highs/lows and chances are that is when you will be buying/selling.

If you are buying to a budget, you are not considering supply and demand. Buying to a budget works in some instances, but not in others. What if the market never gets to your budget? What if your budget is too high/low? Additionally, buying to a budget can leave you uncompetitive relative to others in your industry, but that’s an entirely different issue.

So, what do you do?

Through the years I have developed a repeatable risk management process that takes most of the guesswork out of hedging. The steps to do this are below:

If you don’t have a firm understanding of your true exposure, you may be adding risk to your business instead of removing it. Understanding your true exposure means not only understanding what risks exist in the business, but also the timing of those risks and when they need to be hedged.

Producer Perspective: This means understanding your cost of production and anticipated production.

Consumer Perspective: This means understanding your brand elasticities and your ability to price into the marketplace if needed.

Using the same hedge tool repeatedly in different market conditions is not a solution that works. Just like continual improvement processes in other parts of your business, you need to constantly be thinking about the hedge tools you use and asking yourself whether they make sense given current market conditions.

To be successful, you need to let the market guide which tool you use and even how far out your average coverage should be. To do this, I have always quantitatively looked at the market to tell me whether it is relatively over, or undervalued, for a specific time period and use that as a guide.

Producer Perspective: Your forward coverage and type of coverage should be influenced by the market. When market prices are low, it makes sense to store your grain or buy put options instead of selling cash. Likewise, when market prices are high, it makes sense to sell more of your anticipated production forward and use futures.

Consumer Perspective: Your forward coverage and type of coverage should also be influenced by the market. When markets are low relative to their history, you should have longer coverage in place with futures. Likewise, when prices are historically low, you should have less coverage and prefer using more options with downside protection.

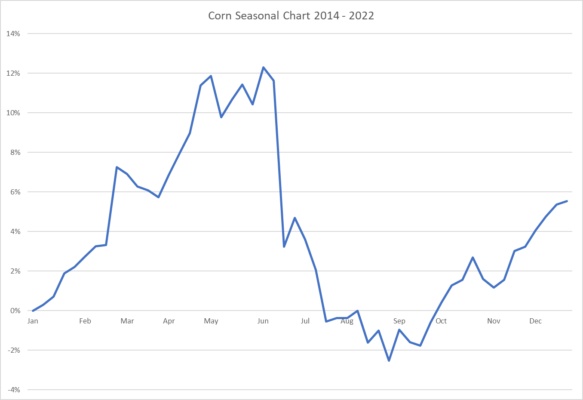

Successful hedging requires taking seasonal market tendencies into account when looking at duration. Does it make sense for an end user of corn to cover their needs for the upcoming year between May and July? Probably not. If they were willing to wait until August to October (only a short difference) the seasonals would be working with you instead of against you.

The backbone of any risk management program is the entry and exit tool. For my strategy, I tend to use two different tools:

In combination, both indicators work in coordination. The ER tool allows hedge managers to always have a price in mind and a reference level they are targeting. The systematic indicator then supplements the ER tool and tells the hedge managers when prices are significantly overbought or oversold.

The idea is to take as much of the guesswork out of market timing as you can and replace it with a process that’s repeatable and testable. I have spent years developing these processes and it has worked well for me.

Interesting in learning more about the systematic indicator? I have posted some back testing results below and have also published a short article going into more detail, Here.

Once hedges are established, they need to be maintained. Conducting pre and post analysis let me optimize hedges while they are still working for the business and also provide the opportunity for lookbacks to see what could be improved going forward.

Does the systematic risk indicator work?

Note: for example purposes these results are built using futures only. In a real-world scenario, different tools would be deployed for different scenarios that would allow the user to better tailor the results to their business. I could not show those results here for obvious reasons.

Interested in learning more about my risk management process or my systematic hedging model? Send me a quick note, I’ll get back to you soon.