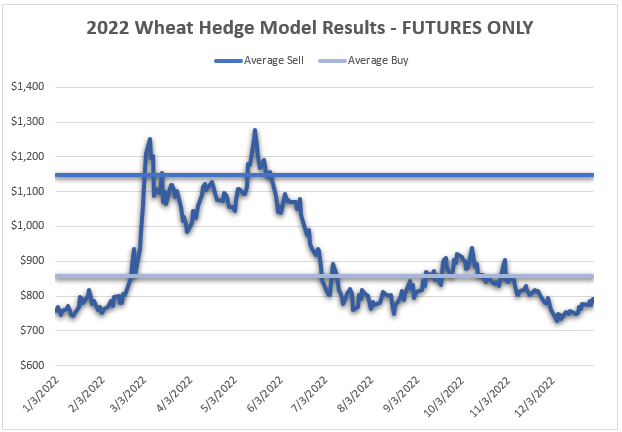

Below are the results of my systematic hedge model when applied against wheat for the entire calendar year of 2022. 2022 ends up being an interesting year for wheat because that’s the year that the Russia/Ukraine War broke out and wheat saw explosive upside. The market was full of emotion throughout the whole year as no one knew what would come next. Taking the emotion out of hedging and relying on the systematic model continues to work, even in these challenging environments.

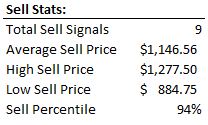

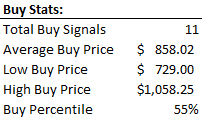

MODEL STATISTICS ASSUMING 100% FUTURES:

As you can see from the above, the systematic model continues to work well with the average sell price of $11.46/bu and the average buy price of $8.58/bu, both over the entire calendar year.

This is also a good opportunity to explain more about the duration and tool rules I use while hedging. I talk a lot about using the relative value of the market guide your duration and tools. Applying this logic would have altered your typical strategy for producers and consumers by:

Producers:

- Extending longer coverage than typical to take advantage of prices that are at the higher end of their 30-year range.

- Diversify strategies but favor firm floors by selling futures or buying puts.

Consumers:

- Lighten coverage while at extreme prices so that you are able to “weather the storm.”

- Prefer optionality, but shy away from positions with tight ranges. With extreme average daily ranges, you should spend some money on option premium that allows downside.

In both instances – stay nimble.

Want to learn more about my process and see other results? Click Here.

Want to Receive Buy/Sell Alerts?

Send me a message, I’ll get back to you shortly.