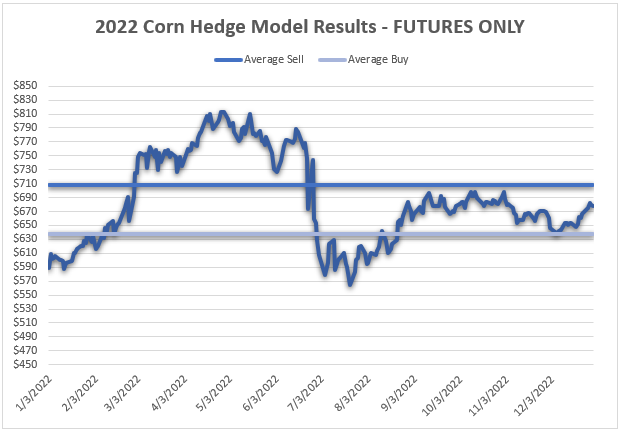

Below are the results of my systematic hedge model when applied against Corn for the entire calendar year of 2022.

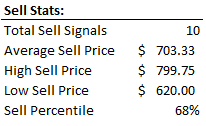

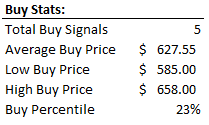

Model Statistics Assuming 100% Futures:

As you can see, for calendar year 2022, assuming that we only bought or sold futures contracts, the average corn sell signal was $7.08/bu and the average buy signal was $6.37/bu.

This is again, only using futures. My hedging strategies allows for optimization by altering the tools that are used to different market conditions. Given the current market conditions at the time, I would have:

- Added producer coverage with short futures, collars, or 1X2’s that provide the firm floor we are looking for, but also allow for prices to move higher. In this case, I would have been looking for opportunities for prices to move higher than our $7.08 sales average and would have optimized coverage at that time.

- Added consumer coverage really heavily on the options side. Given where prices were relative to their history, paying some option premium to allow for downside makes sense. I likely would have added coverage using 3-ways, call spreads, or collars depending on risk tolerance.

Want to Know More?

Send me a message, I’ll get back to you shortly.