Starting today (8/4/2023) I am going to detail a hypothetical farm and feed mill that I will execute grain hedges and energy hedges for. Throughout the year, I will be selling grain on behalf of the producer and buying grain on behalf of the feed mill. I will detail all of the hedges made, their outcomes, and once 100% sold/bought I will detail what the final price is.

Weekly update to the hedging program will be detailed in the weekly market commentary. You can find a link to each week, here.

Farm Description and Sales:

For example purposes, I am going to assume that I own a farm in Southeast Nebraska that grows corn, soybeans, and HRW wheat. This farm has the ability to use futures and options to hedge grain sales and does so regularly. To estimate production costs, I pulled the average cost of production for corn, soybeans, and wheat in Nebraska from the University of Nebraska website. I am assuming the total economic costs in the cost of production, which includes machinery, equipment, and the real estate opportunity cost for owning the land. I also assume that the crops are irrigated in both instances. Below is my estimated cost of production for the 2023 planting season. For now, I will be assuming that the cost of production remains flat for the 2024 planting season but will update these numbers as soon as I have more information.

- Corn: 239 bushels per acre at a cost of $4.74/bu

- Beans: 73 bushels per acre at a cost of $10.57/bu

- Wheat: 98 bushels per acre at a cost of $6.85/bu

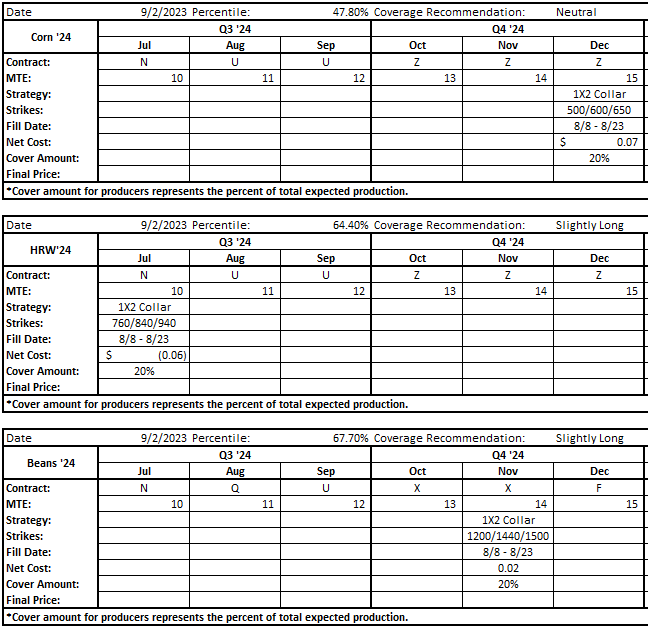

Note: Due to the off timing of starting this exercise, right after HRW harvest and right before corn and bean harvest, most sales will be for 24/25 production as most of 23/24 is already covered.

Below is my current producer positioning. I post weekly updates of the positioning changes I am making in my Weekly Market Commentary.

Want changes to these models sent straight to your email each week? Sign for the free newsletter below:

Feed Mill Description and Buys:

For the example feed mill, I will be assuming that we have the ability to use futures and options to hedge our exposure and do not have any type of hedge accounting treatment that I need to worry about. The primary exposure is to Corn, Soybean Meal and Natural Gas.

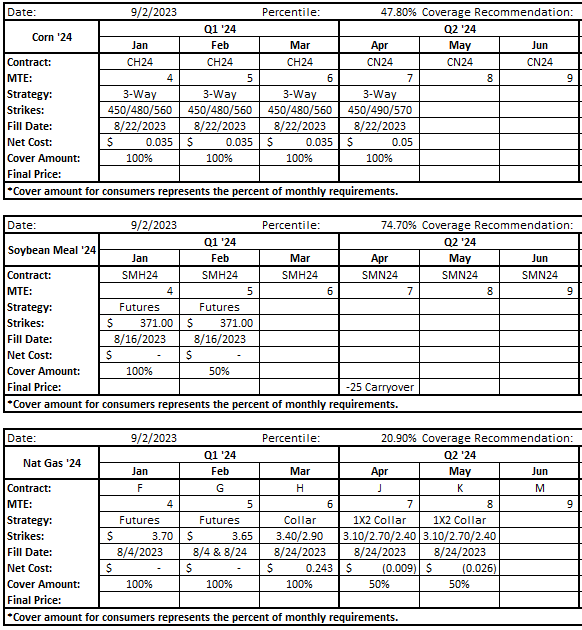

Note: Given the timing of me starting this exercise (August 2023), most of the feed mill purchases will be early sales for 2024.

To simplify things, I will be assuming that all positions expire at the beginning of the month prior to use (so Q1 positions need to be given up the first week of December). I will also be assuming that each quarter only uses one futures contract with the exception of Natural Gas. In reality, there are quarters that use more than one contract, but that complicates the record keeping as it relates to this post. In the end, whether you are using one or more futures contract per quarter is less important. What’s more important is the timing of the sales.

Contracts:

- Q1: March

- Q2: July

- Q3: Sep

- Q4: Dec

Below is my current consumer positioning. I post weekly updates of the positioning changes I am making in my Weekly Market Commentary.

The -$25/ton carryover in April ’24 Soybean meal is due to selling some futures that I had on for a $25/ton profit. Details of that trade can be found here.

Note: All of these actions are based solely on a hypothetical grain producer and consumer. These are not intended to be used as live buy and sell recommendations and are for educational purposes only. Please carefully consider the risks and opportunities before making and determinations of your own.