Welcome to the third post in a series titled, Fundamentals of Grain Hedging: Collars. In this series I discuss different types of hedging and risk management strategies used around the industry. This post will specifically cover producer and consumer collars.

Before we get started, if you are not familiar with buying and selling put and call options, please go back and read post two in this series titled, Fundamentals of Grain Hedging: Options. Reading this will help you to build the base needed to fully understand collars, their implementation, and their pitfalls.

Simply put, a collar is a protective hedging strategy that completely removes upside price risk while still maintaining some downside opportunity for consumers.

For producers, collars completely remove downside risk while still maintaining some upside opportunity.

The way that a collar is achieved is by simultaneously buying and selling options. In the case of a consumer, you would buy a call option at or above the market and sell a put option below the market.

For producers, you would buy a put option at or below the market and sell a call option above the market.

Collars are a great way to reduce exposure risk while still maintaining some flexibility to price improvements.

Let’s take a closer look at a few examples of consumer and producer collars.

Grain Hedging: Consumer Collar

In the first scenario, let’s assume that you are a consumer for corn. It is the middle of August; you have just put together your budget for the upcoming year and you need to be able to ensure that you are able to meet that budget. At the same time, you realize that you don’t know where prices may be headed over the next few months, but you don’t think they are at their lowest point.

For the sake of simplicity, let’s assume that your Q1 (March, CH24) requirements for corn are 5,000 bushels, or one futures contract. Let’s also assume that you are trying to cover 100% of those needs. The current market is trading at $4.95/bu and the budget that you need to achieve is $5.15/bu or better.

The cost of a $5.00/bu call option is $0.28/bu, which would put you over your budget. What do you do? To keep the price of the position reasonable, you can sell a put option below the market.

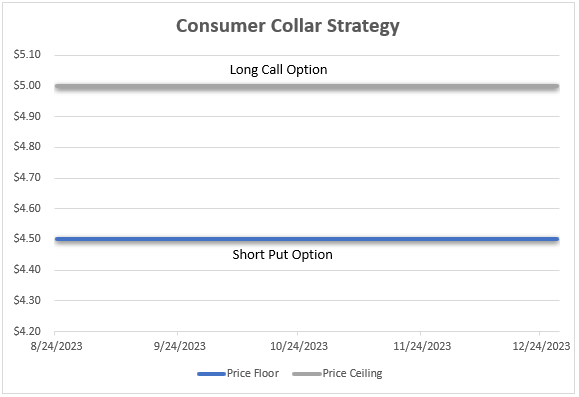

You look at a chart to find the relevant support and resistance areas, take seasonal considerations, and land on $4.50/bu as the area that you don’t see the market going much below. A $4.50/bu put is also trading at $0.12/bu, which means if you sell it your net position cost would be $0.16/bu ($0.28 – $0.12). Graphically, the strikes of the options and how they behave would look something like the below.

Let’s review the potential outcomes of the position. In the first scenario, let’s assume that harvest goes poorly, and the corn crop declines materially. At expiration, instead of trading at $4.95/bu (where it is today), corn is now trading at $5.95/bu. In this scenario you would have been protected from any price risk above $5.16/bu ($5.00 Long call + $0.16 premium). In fact, the price could have gone to $10.00/bu and your price would have been $5.16/bu. You have completely removed upside exposure from your business and met your plan objective.

In the second scenario, let’s assume that harvest goes well and there is more corn than expected. The price of corn is now trading at $4.20/bu instead of $4.95/bu, like it was when you decided you needed to action something. In this scenario, your price would have moved lower with the market from $4.95/bu to $4.50/bu, where you sold the short put. Adding the cost of the premium back, your net cost would be $4.66/bu. The result is a price that is $0.46/bu above the market, but you still saw a $0.29/bu improvement over having just bought the futures and you were still able to beat your plan objective.

In the final scenario, let’s assume that things have gone just how you had expected. The price of corn is now trading at $4.55/bu at expiration. In this case, your price would be the market price plus the option premium that you spent, or $4.71/bu.

As you can see, selling the put option puts a “price floor” below the market, but also reduces the premium by an amount that allows you to still meet your budget expectations.

Grain Hedging: Producer Collar

A producer collar is the exact same strategy as a consumer collar, just the opposite. Instead of buying a call at or above the market and selling a put below the market, you would buy a put at or below the market and sell a call above the market. Let’s go over an example.

Let’s assume that it’s the middle of August, you are getting ready to harvest your crop and plan on putting it in the bin for a while to take advantage of the ~$0.30/bu carry in the market. For simplicities sake, let’s assume this for 5,000 bushels, or one futures contract worth of corn. You notice that July ’24 corn is trading at $5.15/bu today and want to protect that price, but also don’t want to completely give up your ability to see higher prices later.

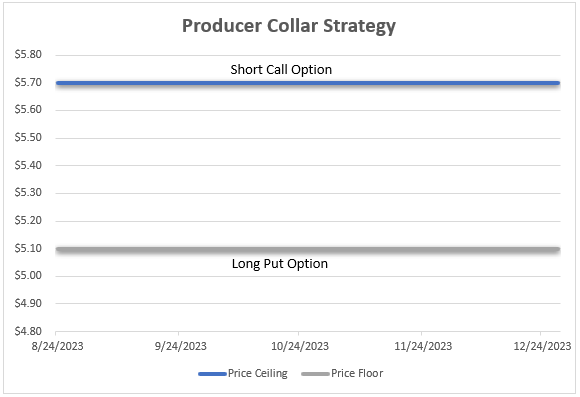

You decide that you would like to buy the $5.10/bu put option and sell the $5.70/bu call option. The net cost of this position would be $0.15/bu, but it provides firm downside protection below $5.10/bu and allows flexibility between $5.10/bu and $5.70/bu if prices move higher. Graphically, the strikes of the options would look something like the below.

To review the potential outcomes, let’s first assume that demand for corn doesn’t show up and the market remains weak. Instead of trading at $5.10/bu when you go to deliver your corn it is trading at $4.75/bu. In this instance, you would still sell your corn at $4.95/bu, or $0.20/bu above the market (5.10/bu put option – $0.15/bu premium spent on the position).

In the second scenario, let’s assume that the market rallies and is trading at $6.00/bu in July when you plan to deliver you corn. In this example the price you would sell your corn at increase with the market up until the short call that you sold – in this case $5.70/bu. Subtracting the premium from this, the net price you receive would be $5.55/bu, $0.40/bu better than you would have received by selling it at harvest. Sure, the argument can be made that you would have been better off in this instance doing absolutely nothing, but doing that you would have been exposed to a significant amount of uncertainty and would have zero price protection.

In the final scenario, let’s assume that corn rises moderately between now and July, when you plan to deliver your corn. Instead of trading at $5.15/bu, where it is today, it’s trading at $5.50/bu. In this case the price you receive for your grain would have appreciated with the market since it is between your put option and your call option. The price you ultimately receive for selling your grain would be $5.35/bu.

As I mentioned at the top, this post is the first in a series on grain hedging. The following posts can be viewed here.

- Fundamentals of Grain Hedging – Futures

- Fundamentals of Grain Hedging – Options

- Fundamentals of Grain Hedging – Collars (this post)

- Fundamentals of Grain Hedging – 3-Ways

- Fundamentals of Grain Hedging – OTC Products.

Note: This post is for education purposes only and is not a trading recommendation. Please consult a marketing advisor before making any decision to buy and/or sell options.