Quote of the week: “When you can’t control the events in your life, control your reactions. That’s how you will regain power.”

Fact of the week: An ant’s sense of smell is stronger than a dogs.

Last Week:

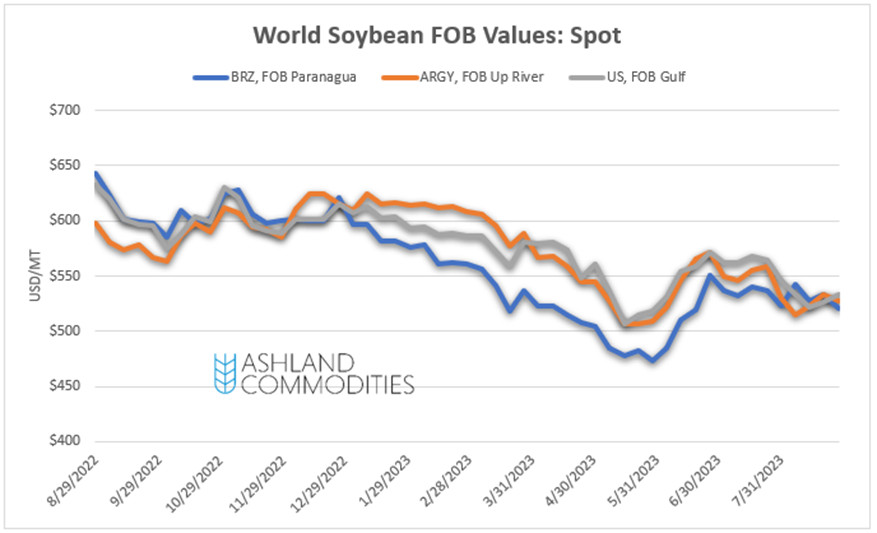

- The soybean market gapped higher again on Sunday night from the continued hot/dry weather and fears that it may have on the yield. My belief is that these fears are justified. The soybean balance sheet has very little margin for error in the upcoming year. If you take as much a one bushel out of the yield we are in a spot where we need to cut exports or our stocks/use is at ~3.5%, or 12 days of supply…. Things are tight.

- Broken record – but there are continued issues over crop production in China and India. Those two countries represent ~35% of the world’s population, so any issue can potentially mean big time imports.

- Along these lines, China was back in the US market buying soybeans this week. Well, China bought 132k mt on Thursday and “Uknown” bought 291k mt on Monday and 246k mt on Tuesday…

- On the soybean export sales topic. I did a bit of research this week looking at the percent of net commitments for the last week in August vs the August WASDE. What I found was that even with the recent soybean buying, we are only ~25% committed for the MY, which should be characterized as “normal” for this time of the year. Yes, the US crop may be getting smaller, and the margin for error is very slim, but I think it’s a stretch to say we are putting on a massive export sales book in August.

- Farm futures released their annual survey of planting intentions. They had 93.1M corn, 85.4M beans, and 52.7M wheat acres. This is very surprising to me. First, if we are struggling to come up with corn demand this year, why would we plant so much next year? Also, where are the wheat acres coming from? Certainty not SRW… I’ve talked to producers who are doing the math and concluding that they can’t plant SRW and make money next year given WN24 futures at 660/bu.

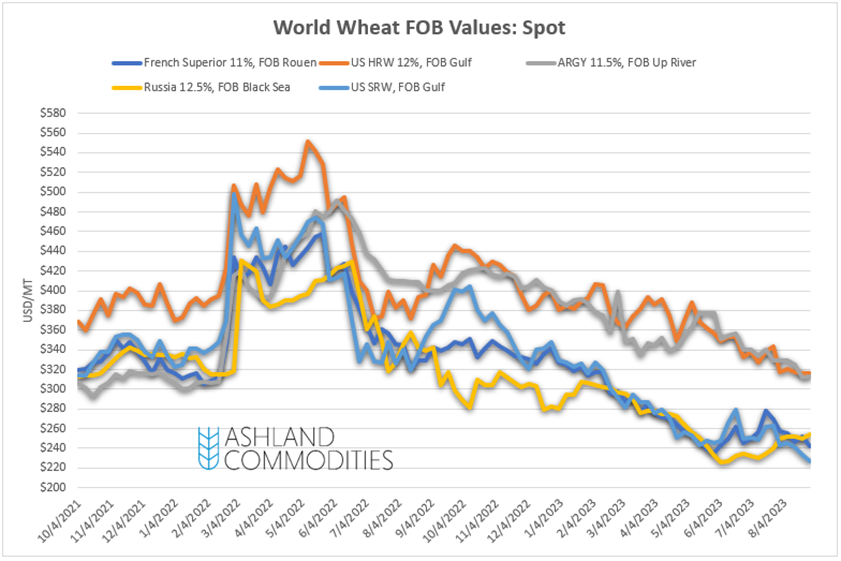

- Egypt tendered wheat this week and the winner was French wheat coming in at 259.42/mt. Truthfully, Russia still has the cheapest wheat in the world, but their price floor set at 270/mt excluded them from this bid. Longer term, I wonder how long those price floors will remain. Yes, Russia needs the revenue to fund the war, but they also have a big wheat crop for the second year in a row.

- WTI crude oil prices are at their highest levels since August of 2022 as seasonally the US saw a large decline in stocks this week. To make matters worse, Russia reportedly agreed to further output cuts with OPEC+.

Next Week:

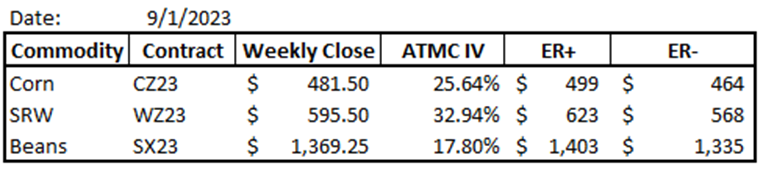

Above are the expected ranges for the upcoming week. ER+ means that if market momentum is higher, we are likely to achieve that price target. ER- means that if market momentum is lower, we are likely to achieve that target. Any move outside of either range would be considered an “outside” week.

- Corn and bean harvest is quickly approaching in the US and the focus will remain on yields. The average market participant will tell you they expect both corn and soybean yield to decline, the question is by how much. Realistically, we have less than 1 bushel available on soybeans before we need to start rationing demand. Corn has a slightly larger margin for error. If the USDA stays above a ~169 yield on corn prices will likely have a tough time rallying.

- Speaking of corn, I did some digging this week to look at just how much the hot/dry weather can impact yields. According to Purdue University, the difference between ~70k corn kernels in a bushel and ~100k kernels in a bushel is ~100 bushels an acre… grain fill matters.

- South America starts planting beans in a few weeks, so their weather forecast will become increasingly important. Long-range forecasts don’t look great either, which will be a concern. Typically, an El Nino means dry weather for Brazil and wetter weather for Argentina. If that holds, production in Brazil should decline (assuming acres are held constant) and Argentina should see a recovery.

- Likewise, weather in Australia will become increasingly important. El Nino also means hot/dry weather for Australia, and they are already seeing some of it, so I suspect the wheat bulls will start beating that drum shortly.

Want this delivered straight to your email every weekend for free? Sign up below.

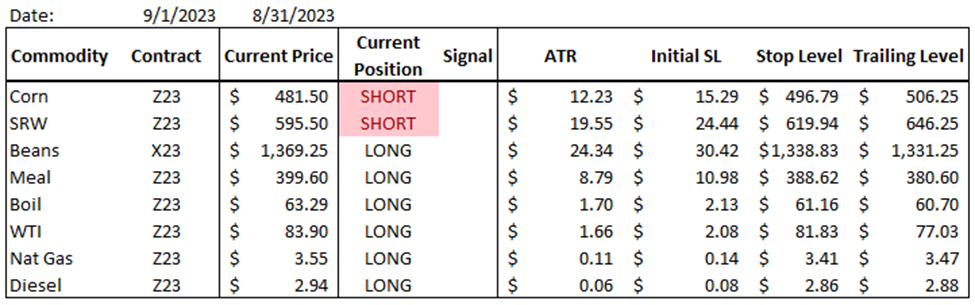

Trend/Spec Models & Positioning:

Below is a summary of my primary trend model positioning, any weekly changes that were made, and any other spec related longer-term positions that I have on. I occasionally will trade into and out of positions during the week. Those are not reflected here. The purpose of this is to show the longer-term trades and to watch them run their course.

I made a couple of adjustments to my spec/trend models this week:

- I exited my CK24-WK24 long spread trade for 24 cents profit. I had added this trade at -156 on 8/17 and quickly started losing money as it went down to -175. The seasonal tendency for this spread is solid though with a 100%-win rate over the last 15 years, so I held onto it. Earlier this week I was in the money 24 cents and just decided it was time to call it a day.

- On 8/30/23 I sold the NGK24 – NGN24 spread at -.209. This is another one that has a very strong seasonal tendency and a 100%-win rate over the last 15 years.

- I am also keeping a close eye on the CH24-WH24 spread. There is a chance that I will take that trade in the coming weeks as well.

Previously Mentioned Positions:

- Short Dec corn at $507

- Long Dec diesel at $2.37

- Short Dec SRW $624

A quick note on the Short WZ23 @ $624. This is a PRIME example of how taking the emotion out of the market makes all the difference. A few weeks ago, I wrote about how I got a short signal and didn’t take it on SRW and lost the opportunity. A week or so later I got another opportunity to short based on my model and took the trade but wrote about how I thought I would be stopped out because it looked like we were close to a bottom. Well, my emotions were wrong there and I am now in profit by ~30 cents on the trade…

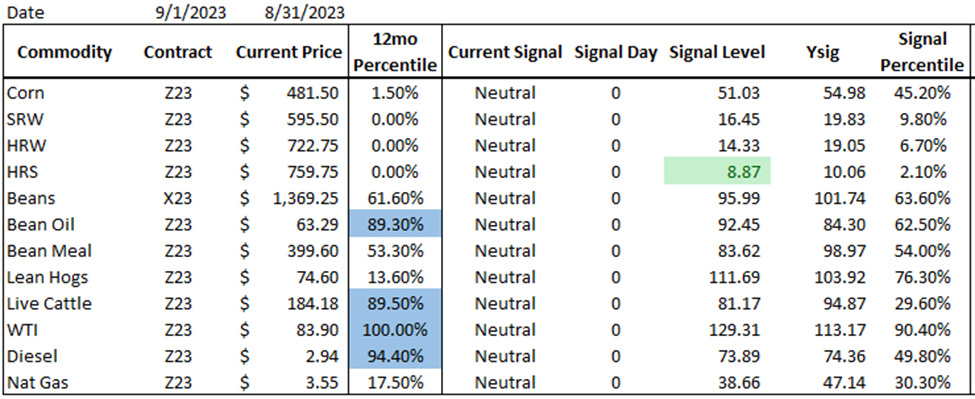

Hedge Models & Positioning:

Below is a summary of my hedge model positioning and any weekly changes that were made. In addition to this, I have also created charts below that show the detailed coverage I have on. As a reminder, my hedge model is a trend reversal model that signals significantly overbought and oversold conditions in the intermediate timeframe. These models typically produce 5-10 buy/sell signals per contract annually.

This week my hedge model gave off a few signals. Summary below:

- Sell SX23 Soybeans at $13.92 (8/29)

- Sell SMZ23 Meal at $418.8 (8/28)

- Buy WZ23 Wheat at $607 (8/30)

- Buy MWZ23 Wheat at $768.25 (9/1)

Along with these signals, I exited SMN24 meal long futures at $395 on 8/29. The total gain on this position was $25. My thinking here is that longer term soybean meal will struggle, and I will likely see the opportunity to replace the coverage at better levels. Yes, US beans will remain tight, but if Argentina sees a return to normal in their crop our exports should relax, and meal prices should stay weak. At the same time, the continued expansion in renewable diesel in the US, and the crush capacity that is going along with it, means that by Q2 of ’24 we will be producing more meal that we are today.

There were no other changes to hedge coverage this week.

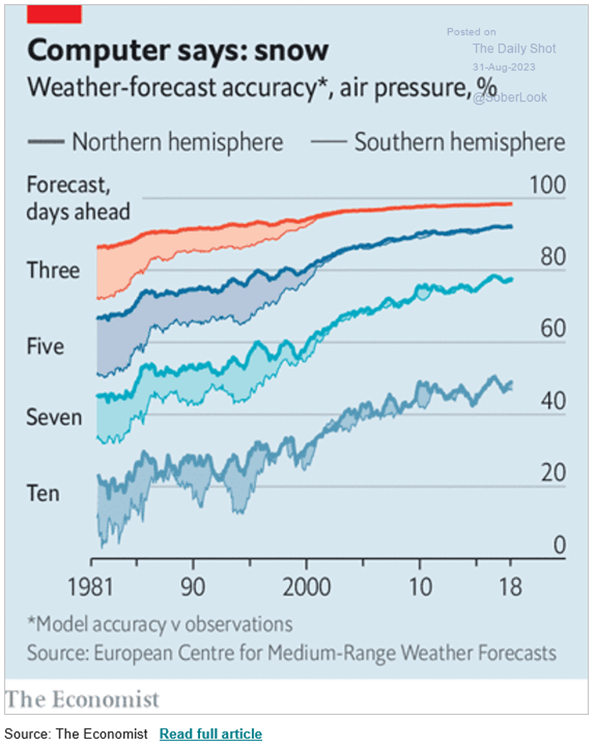

Something to Think About:

I found this chart very interesting. Anyone in commodities knows how important weather forecasts can be but tends to put very little stock in whether the forecasts are accurate (I am included in this as well). The above chart shows a forecast for snow and the accuracy levels from 3 to 10 days out from 1980 to today. Obviously, forecast accuracy is improving, but a 10-day forecast is still only about 50% accurate….

Want this delivered straight to your email every weekend for free? Sign up below.

Charts:

December Corn: 4 hour

December Wheat: 4 hour

November Beans: 4 hour

Note: nothing in this post constitutes a buy or sell offer. All information is meant for educational use and is simply used to display various hedging and risk management techniques. If you are interested in trading and or hedging with derivative products, please carefully consider the risks and consult a registered professional.