Quote of the week: “If you feel like giving up, look back at how far you’ve come.”

Fact of the week: The word “robot” comes from a Czech word “Robota,” which means “forced labor, compulsory service, drudgery.”

First, I apologize for taking a few weeks off. Life comes at you fast and you don’t always have the time or the energy to put together a free weekly summary… Things should be back on track now.

Last Week:

- Where did the vol go? A few weeks ago, vol was still pumping, markets were swinging around wildly, and things were excited. Now, it feels like we’re back 4-5 years ago where a move over 5 cents in corn is considered a big day. (I wrote this before Friday’s report)

- … VOL came back on Friday! We will see if it sticks around. Feels like we are headed to a lower price, lower vol environment longer term and are just in the process of figuring out exactly what that means today.

- This week Mexico came in big with a corn purchase of 1.66mmt, split with 1.09mmt delivering this crop year and .611 delivering next. The market initially shrugged it off but was able to show a little bit of strength later in the week before being drug down by wheat on Friday.

- On Friday the quarterly stocks report and the annual small grains report was released by the USDA. Overall, I would consider the report:

- Bearish wheat without a doubt

- Somewhat neutral corn

- Slightly bearish soybeans

- The market reacted to these reports by selling off hard. By the close all major grains and oilseeds were down by double digits with SRW wheat down almost 40 cents and the Z/H spread widening out by over 4 cents…. Crazy day

Next Week:

- A few weeks back I said that I thought the market would trade rangebound until/unless 1 of 2 things happened – the first being the USDA making material changes to the balance sheets. This happened on Friday for wheat.

- The one interesting thing that the wheat market still must absorb from the reports is the fact that production was called higher, but stocks were basically in line with USDA expectations. Said differently, the USDA announced that the final crop size was going to be called up by a rather large amount, but the available wheat in system on 9/1/23 was not materially different. SO… the feed and residual numbers for wheat are going to be crazy large in Q1? Just something to think about.

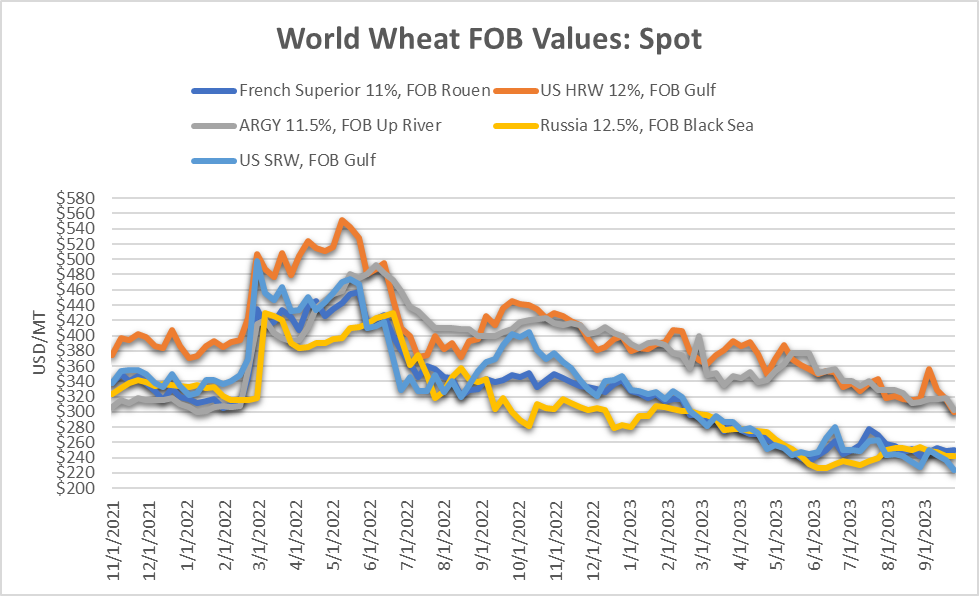

- The Dec Wheat-Corn spread is now at levels that I would consider to be narrow – 65 cents. The rule of thumb that I’ve always used is that when the Wheat-Corn spread is less than 100, there is the chance for wheat to be fed. I struggle to think that will happen right now due to basis implications in the wheat market (more to come in a second), but it’s something to watch.

- Looking to wheat basis… these spreads and moves are anything but bearish wheat basis. Think about it, if you’re holding SRW wheat today (sitting at 100% of FC) why would you sell it? The Z/H spread represents roughly a 6% return over three months (valuing storage costs a 0, which many producers do). If I’ve got SRW wheat sitting in a bin somewhere today you’re either going to have to pay me a huge basis number, or you can see me in 6-9 months after I’ve captured that carry.

- Demand, demand, demand. Where is demand?

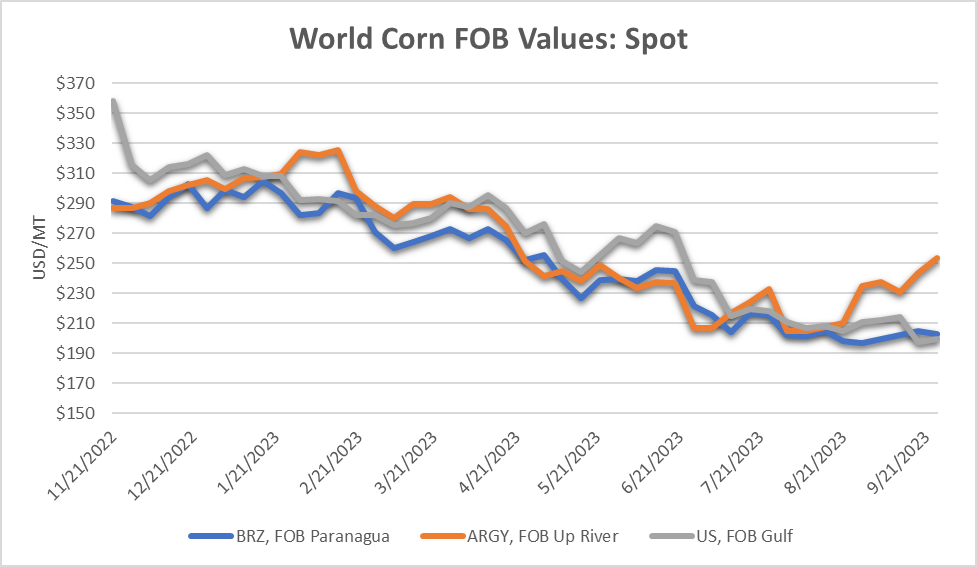

- Corn: recent export sales to Mexico are something to watch, but we need more demand than Mexico to get the market excited and that’s not what we’re getting.

- Wheat: SRW is the cheapest wheat in the world and we cant find material buyers – although we are 37 cents closer today than we were on Thursday at close. The problem with SRW is the world only wants so many cookies and crackers. Find a way to make bread out of it and we’ve got demand. HRW exports are absolutely terrible, but it feels like the market is trying to converge with world wheat values after years of trading at a premium.

- Beans: Bean sales have been ok considering the tight US crop. Maybe I eat my words here – I don’t think we’re going to blow bean exports out of the water, but at current pace and prices I think we could meet USDA forecasts.

Want this delivered straight to your email every weekend for free? Sign up below.

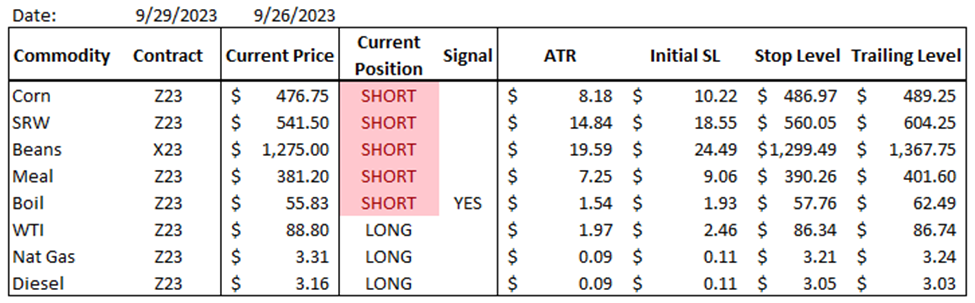

Trend/Spec Models & Positioning:

Below is a summary of my primary trend model positioning, any weekly changes that were made, and any other spec related longer-term positions that I have on. I occasionally will trade into and out of positions during the week. Those are not reflected here. The purpose of this is to show the longer-term trades and to watch them run their course.

I made a couple of adjustments to my spec/trend models this week:

- Closed out my SH-SK 24 bear spread. I had entered this trade a few weeks back at -2.6 knowing that a very strong seasonal tendency occurs around this time of the year. I exited this week at -8.5 for a total gain of 5.9 cents per contract.

- My trend model also flipped short soybeans, so I shorted SX23 at 1291.75. I was underwater and worried until the report on Friday. Now I’m 20+ cents in the money per contract and feeling confident… Another great example of taking emotions out of the market.

- I was stopped out of my corn short this week at $484. It was about time. The market had become rangebound which just allows my stop to get closer and closer to the market each day. Overall, I profited 23 cents per contract on the trade.

- I also finally stopped out on Diesel this week. It was one hell of a run! Honestly, one of my better trades this year. Entered at $2.37/gal and was finally stopped out at $3.07… that’s trend trading.

Previously Mentioned Positions:

- Short Dec SRW Wheat $624

- Short NGK24-NGN24 spread at -.209

- Short Dec soybean meal at $396.2

Also note, I received a signal on Bean Oil at the close on Friday. I will be shorting BOZ23 at the open on Sunday.

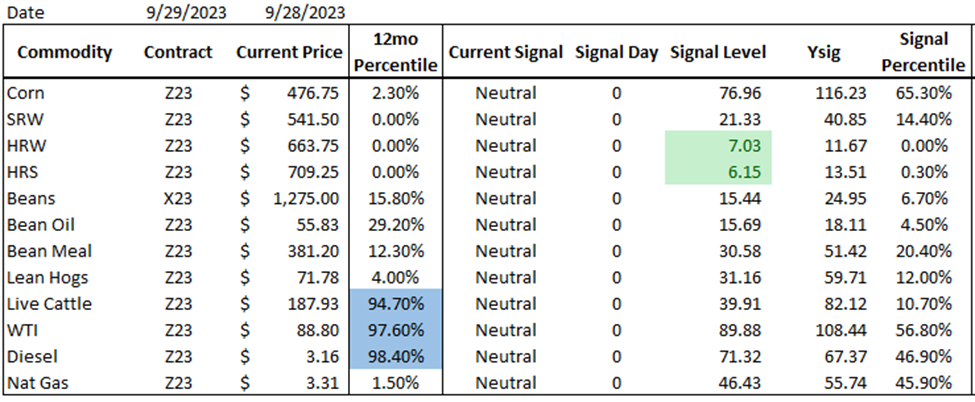

Hedge Models & Positioning:

Below is a summary of my hedge model positioning and any weekly changes that were made. In addition to this, you can also see my full hedge coverage at any time by going to my website, ashlandcommodities.com, and clicking on the 2023 hedge coverage post. As a reminder, my hedge model is a trend reversal model that signals significantly overbought and oversold conditions in the intermediate timeframe. These models typically produce 5-10 buy/sell signals per contract annually.

This week, my model gave off a few buy and sell signals. I tend to post these signals on my twitter account the mornings they occur. Iin case you missed it, or I didn’t post it, below are the signals this week:

- Buy SX23 at 1297.5

- Buy BOZ23 at 57.71

- Buy KEZ23 at 663.75

- Buy MWZ23 at 709.25

Overall, this week was quiet on the signal front. That tends to happen when markets are more rangebound or there’s a lack of clear direction though.

From a hedging perspective, this week I did not make any changes to my coverage. I seriously considered adding some additional corn coverage for May and June early in the week with options and am still looking for an opportunity to add some soybean meal coverage but haven’t yet.

Want to know all of the current hedge positions? CLICK HERE

It’s probably worth calling out as well, for educational purposes, that I am underwater on my Jan and Feb nat gas hedges. I’ve got January gas covered at $3.70 vs the current market at $3.61. No real reason to panic today, but part of the hedging process is continual evaluation. I will be looking for opportunities to adjust and enhance my Jan/Feb nat gas coverage going forward as well.

Want this delivered straight to your email every weekend for free? Sign up below.

Charts:

December Corn: 4 hour

December Wheat: 4 hour

November Beans: 4 hour

Note: nothing in this post constitutes a buy or sell offer. All information is meant for educational use and is simply used to display various hedging and risk management techniques. If you are interested in trading and or hedging with derivative products, please carefully consider the risks and consult a registered professional.