This article is the second post in a series titled, Fundamentals of Grain Hedging: Options. In this series, I discuss different types of hedge strategies that are used around the industry by grain producers and consumers.

The focus of this article is grain hedging options. In subsequent posts I will discuss more complex structures such as collars, 3-ways, and OTC products.

To start, the purchaser of an options contract has the right, but not the obligation, to buy or sell a specific commodity at a specific time, place, and quantity. Conversely, the seller of an options contract has the obligation to buy or sell a specific commodity at a specific time, place, and quantity.

There are two primary types of options contracts: calls options and put options. Call options are also known as caps and ceilings and put options are also known as floors. A call option protects the buyer against rising prices. A put option protects the seller against declining prices.

Call options and put options can be bought and sold against several grain futures contract including, but not limited to, corn, soybeans, wheat, soybean meal, and soybean oil.

Grain consumers will often purchase call options as a component of their risk management strategy to mitigate their exposure to higher prices.

Grain producers will often purchase put options as a component of their risk management strategy to mitigate their exposure to lower prices.

Let’s take a closer look at these two examples to get a better idea exactly how these strategies work.

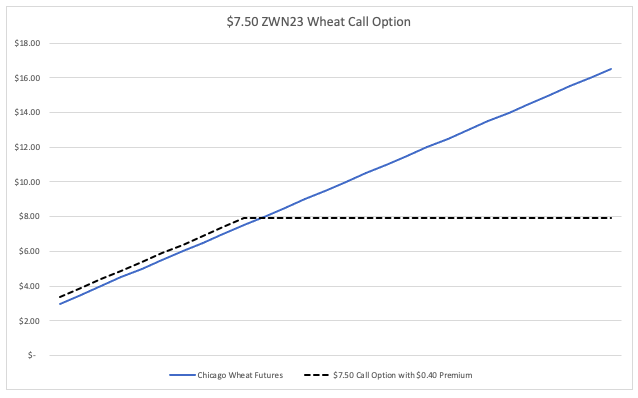

Grain Hedging: Consumer Call Option

In the first scenario, let’s assume that you are a consumer of wheat flour, specifically Chicago Soft Red Wheat flour. It is the end of December; you have just set your budget for the upcoming year and you need to ensure that you are able to meet that budget for the year.

For simplicities sake, let’s assume that your July requirements of wheat (before conversion to flour) are 5,000 bushels, the equivalent of one futures contract, and that you are trying to hedge 100% of that volume. The current market is trading at $7.50/bushel and your budget is roughly $8.00/bushel for the year.

To accomplish the hedge, you decide to cap your anticipated price using a call option. Since you are hedging you risk for July requirements, you would hedge using the ZWN23 contract. At the time of writing this, a $7.50 ZWN23 call option is trading for roughly $0.40 cents, which puts your net ownership at $7.90/bushel. If you had purchased this contract today it would have cost you $2,000 per contract (40 cents X $50 per cent).

Now, let’s look at how this strategy would have performed under different market conditions.

In the first scenario, let’s assume that there is a drought and wheat prices increase between now and when the options contract expires. At expiration the price of wheat is $8.20/bushel. In this scenario your hedge would have profited, or gained, $0.30/bu after account for the initial premium. As a result, you would have received a net of $0.30/bushel, or $1,500 dollars, from your broker to offset the $8.30/bushel cash wheat cost that you incurred. The net cost of your wheat would be $7.90/bushel.

In the second example, let’s assume that the weather is great and wheat prices decrease between now and when the options contract expires. At expiration the price of wheat is $6.40/bushel. In this scenario your hedge would be “out-of-the-money” and would have expired worthless. However, that is not necessarily a bad thing. Since you used a call option to execute your hedge, your price would have declined with the market as well. Once the premium has been takin into account you would have paid $6.80/bushel for your wheat instead of $7.90/bushel.

As this example highlights, call options are fantastic tools for consumers to use when managing risk. They allow you to protect your upside risk while still maintaining downside exposure to lower prices.

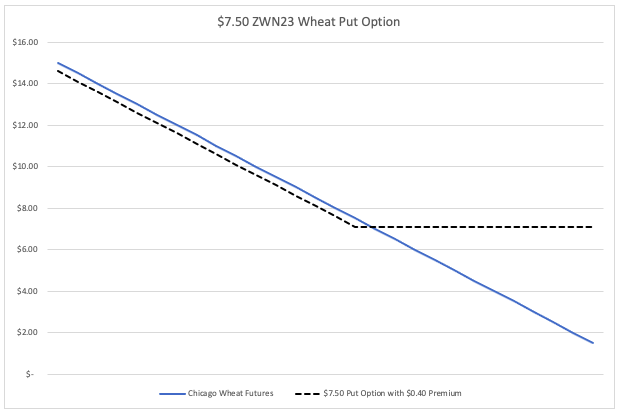

Grain Hedging: Producer Put Option

In the next example, let’s assume that you are a wheat farmer. Again, let’s assume that you grow Chicago Soft Red Winter Wheat. It’s the end of December, your crop is currently dormant, and you know your cost of production for the upcoming year.

For simplicities sake, let’s assume that you plan to harvest 15,000 bushels in late June to early July, the equivalent of 3 futures contracts, and that you are considering hedging 1/3 of that volume today, or 1 contract. The current market is trading at $7.50/bushel.

To accomplish the hedge, you decide to create a floor by using a put option. Since you are hedging your risk of prices moving lower before you can sell your crop in July, you will hedge with the ZWN23 contract. At the time of writing this, a $7.50/bushel put option is trading at roughly $0.40 cents, which puts your net ownership at $7.10/bushel ($7.50 – $0.40 = $7.10). if you had purchased this contract today it would have cost you $2,000 per contract (40 cents X $50 per cent).

Now, let’s look at how this strategy would have performed under different market conditions.

In the first scenario, let’s assume that the weather is great and wheat prices decline between now and when the option expires. At expiration, the price of wheat is $6.50/bushel. In this scenario your hedge would have profited, or gained, $0.60/bushel after accounting for the premium. As a result, you would have received a net of $0.60/bushel, or $3,000 dollars, from your broker to offset the $6.50/bushel cash wheat cost you would have sold at. The net cost of your wheat would be $7.10/bushel.

In the second scenario, let’s assume that there is a drought and wheat prices continue to chug higher between now and when the option expires. At expiration, the price of wheat is $8.20/bushel. In this scenario your hedge would have expired “out-of-the-money,” or worthless. This is not necessarily a bad thing though. Since you used a put option to execute your hedge, your wheat price would have increased with the market. Once the premium has been takin into account you would have received $7.80/bushel for your wheat instead of $7.50/bushel.

As this example highlights, put options are great tools for producers of commodities to use when managing their risks. They protect the producer against lower prices while still allowing for higher prices to be realized.

As I mentioned at the top, this post is the first in a series on grain hedging. The following posts can be viewed here.

- Fundamentals of Grain Hedging – Futures

- Fundamentals of Grain Hedging – Options (this post)

- Fundamentals of Grain Hedging – Collars

- Fundamentals of Grain Hedging – 3-Ways

- Fundamentals of Grain Hedging – OTC Products.