As a producer of commodities, you understand how important it is to manage the risk of price fluctuations in your finished product. Everyday we work with, and talk to, grain and oilseed producers who are looking for cost effective ways to help manage this risk and ensure their profitability.

Unfortunately, there are still many people out there that either don’t understand, or are intimidated by, strategies that use options to help reduce risk. This leaves those producers handicapped in their hedging capabilities, and significantly reduces the amount of tools at their exposure. But it doesn’t have to be like that! There are many options strategies available to producers who have a range of desires and capabilities.

One of the more simple options hedging strategies is a producer collar hedge. A producer collar is a valuable hedging tool that, if used correctly, can provide risk management for your business that is either free, or very close to free.

Let’s take a deeper look at exactly what a producer collar hedge strategy is, how to use it, what the potential outcomes are, and what the risks are.

What is a Producer Collar Hedge?

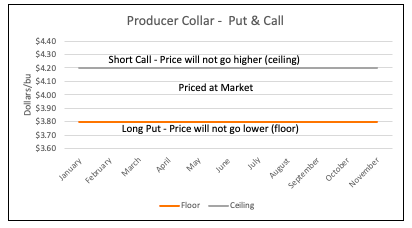

A producer collar is an options strategy that allows producers to put a floor on their downside risk, but also caps their upside potential.

To enter into a producer collar, a producer buys an out-of-the-money put option and simultaneously sells (or writes) an out-of-the-money call option.

In this strategy, the long put option, or the put that has been purchased, profits from price declines, so it ensures that the producer is covered from downside moves. The call option in this strategy is a short call, or one that has been sold, so it generates revenue to help offset the cost of the put, but also puts a ceiling on the amount of upside moves that a producer can capitalize on.

You may be asking, “why would I want to limit further upside gains?” The reason is because it’s cheaper! Everything in life has tradeoffs, and buying a put costs money, so to make the put option cheaper you can sell a call option to help generate some revenue. When all is said and done, a producer collar will usually end up being costless, to near costless… Who doesn’t like free risk management strategies?

Before we get into detail, let’s go over a few of the main advantages, and a few of the main disadvantages, of producer collars.

Advantages of Producer Collars

- Protect your business from falling prices

- Allows for some pricing flexibility

- Prices are usually costless to nearly costless

Disadvantages of Producer Collars

- While your downside risk is capped, your upside risk is capped as well

- There is the potential for margin calls

- This is a price risk strategy, so your business is still exposed to basis risk

How to Use a Producer Collar Hedge Strategy

Just like how hedging strategies are different, the time to use various strategies is different. Below are a few examples of when to use a producer collar to manage risk.

When to Use Producer Collars:

- When you think prices are at the higher end of a range, but want to allow some flexibility

- When prices are at profitable levels and you would like to enter into coverage cheaply

When Not to Use Producer Collars:

- If you think prices are in the middle of a sustained rally and would like to lock in a board value

- When prices are profitable, but you feel that they are at the lower end of their range

Basically, the main objective with a producer collar is to either have prices stay about the same, or decline after you enter into the position. If prices continue to rise after you enter into the position and the call option that was sold goes in the money not only are your gains capped at whatever the strike price of the call was, but you risk receiving a margin call as well.

Entering Into a Producer Collar

Entering into a producer collar is relatively easy to do. The first step is to decide the amount of coverage you would like to enter into and the timeframe that you would like to make a sale for.

Picking the amount of coverage is really up to you. We usually recommend that our clients split their annual production into 10 different amounts that can be hedged throughout the year, and tend to make most of our sales during the “peak months” of March through June – when grains and oilseeds tend to be at their highest levels.

To pick a timeframe you should price a futures contract that most closely aligns with when you plant to deliver the material. For example, if you plan on selling your corn in December, it makes sense to use the December contract.

Once you have determined the amount that you would like to cover and what contract you would like to use it is time to enter into the position. To enter in the collar you will start by picking a price below the current market price to buy a put. Once you have bought the put option you will then pick a price above the current market price to sell a call option. When used in combination, these two options are what provide the collar.

To recap:

- Determine the amount of coverage you would like to have – we usually recommend 10% to 15% in each trade

- Determine the timeframe for your coverage – pick something that aligns with when you plan to make sales

- Purchase an equivalent amount of put options to the amount you would like to cover (ex. If you would like to cover 10,000 bushels of corn you would buy two put option contracts)

- Make sure that the put options are out-of-the-money, or below the current market price

- Sell an equivalent amount of call options to the put options you purchased (if you bought two put options you should sell two call options)

- Make sure that the call options are out-of-the-money, or above the current market price

Potential Outcomes

There are three main potential outcomes for a producer collar – the put expires in the money, the call expires in the money, or both expire worthless. Below are the three potential outcomes for producer collars and what the impacts would be.

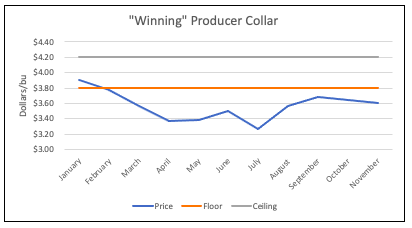

The Put Option Expires In-The-Money

Congrats, this is the ideal scenario! When the put option expires in-the-money it means that the strategy worked out exactly as planned.

The call that you sold expires worthless, so you are able to keep all of the premium that you collected when you sold. The put option expired in-the-money, which means that as the price went down the value of the put increased and offset the decrease in price.

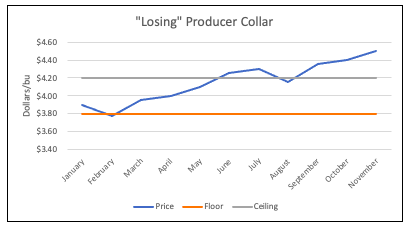

The Call Option Expires In-The-Money

Unfortunately, this is the worst case scenario for a producer collar. When the call options expires in-the-money it means that prices continued to rally and went above the price you sold the call at.

In this instance, your gains were capped at the price level of the call option. This is because as prices continued to climb the value of the call increased, making it more expensive for you to buy back the position. Likewise, the put option expired worthless and did not end up providing any of the coverage you intended.

Note: It is incredibly important to remember that in this instance you did not actually “lose.” If the collar was used appropriately your business would have still been profitable, so any losses on paper would have simply been lost opportunity cost. Always remember, we are hedging, not trading.

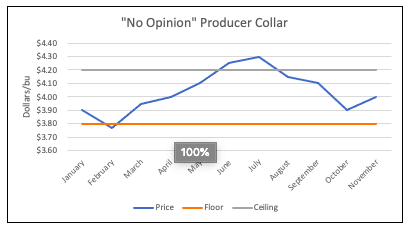

Both the Call and the Put Expire Worthless

In this case you were able to hedge your production for free, but do not end up using the coverage. Think of this scenario as a kind of insurance policy. You put it in place hoping that you never need it and luckily, this time you didn’t.

Still having trouble understanding or implementing the producer collar hedge strategy? Feel free to send me a quick email, I would be happy to help in any way I can.