Quote of the week: “never fade the ones who are willing to show up every day.”

Fact of the week: Drive due South from Downtown Detroit and you will end up in Canada.

Last Week:

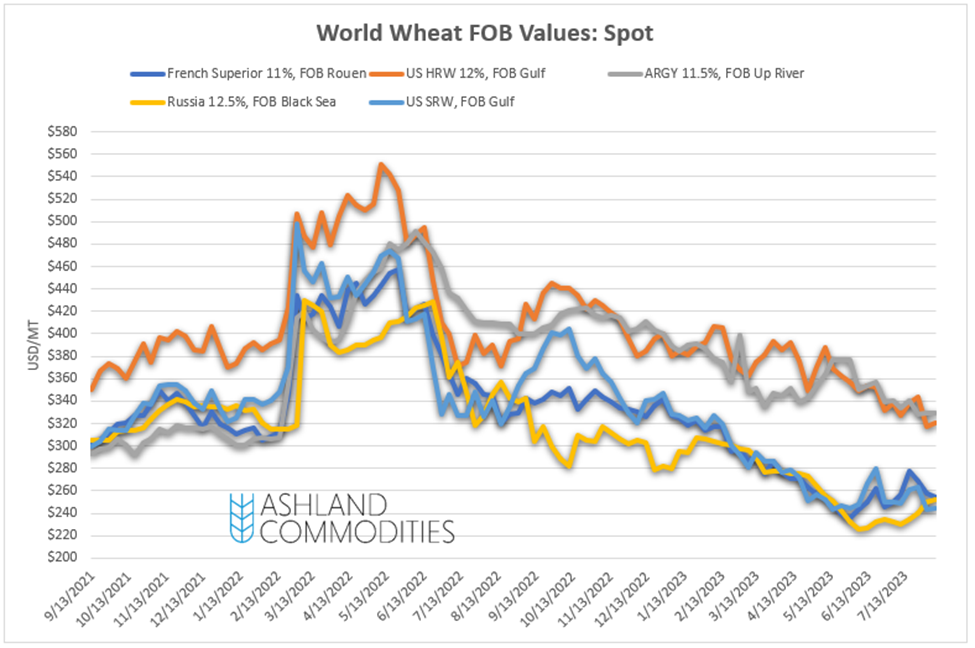

- Beginning the week (Sunday/Monday) the market was very concerned over the impact that Ukraine bombing a Russian “merchant” vessel would have. Ultimately, it turned out that the “merchant vessel” was essentially a Russian military oil cargo ship that was registered as a merchant vessel and the market sold back off. I will say, the half-life of these events just keeps getting shorter and shorter. Two weeks ago, the wheat market would have been limit up on the moves… today, we seem to put some premium in the overnight markets but takes it all out during the day session.

- Over the last few weeks there has been historic flooding in China. The last time something like this happened they stepped into the market and bought 10mmt of corn in two weeks. China is, and will be, one of the worlds largest grain producers and importers. If they have crop issues it very well could cause their imports to increase. At this point, rumors are that about 6mmt of grain has been impacted in China.

- Major food companies including Conagra, Tyson, and Kellogg’s are all releasing earnings with their revenue being down YoY… for those that have worked at a food company it should make plenty of sense: you price until your brand reaches an elasticity tipping point (i.e. consumers push back). What we’re seeing is that consumers are pushing back and substituting around the isle. From here, food companies just hope that the pricing they took allows their margin gains to offset the revenue declines. Time will tell.

- Export sales of soybeans to China – 251k mt on Wednesday

- Export sales of soybeans to China – 251k mt on Monday

- Export sales of corn to Mexico – 132k mt on Monday

- Export sales of corn to Mexico – 143k mt on Friday

- One comment on the continuing export sales. I would consider the export sales of corn to Mexico to be routine. What does spike my interest, however, are the export sales of soybeans to China. The current US soybean balance sheet is set up to see a YoY decline in exports and still have tight stocks. If China comes into the US market in a big way it could very well lead to higher domestic prices.

- Egypt bought some wheat this week. Delivery of the wheat was deferred to the back half of Sep and first half of Oct. Looks like the world values are (i.e. Russia) are still increasing slightly.

- Water levels in the Mississippi River at Memphis are relatively low levels again due to the drought. Keep an eye on this as it could impact interior basis markets and the US’s ability to export grain.

Want this delivered straight to your email every weekend for free? Sign up below.

Next Week:

- The WASDE was released on Friday (link here). It ended up being a virtual snooze fest. There were almost no surprises and the market had already priced in everything that was coming.

- Russia/Ukraine will remain at the top of mind, although the half life of these events continues to shorten.

- The extended weather forecast looks to be turning hot and dry again/ This comes just in time for corn dry down in certain parts of the country, but soybeans are still filling pods in many places, so it could add some risk premium back into the soybean market.

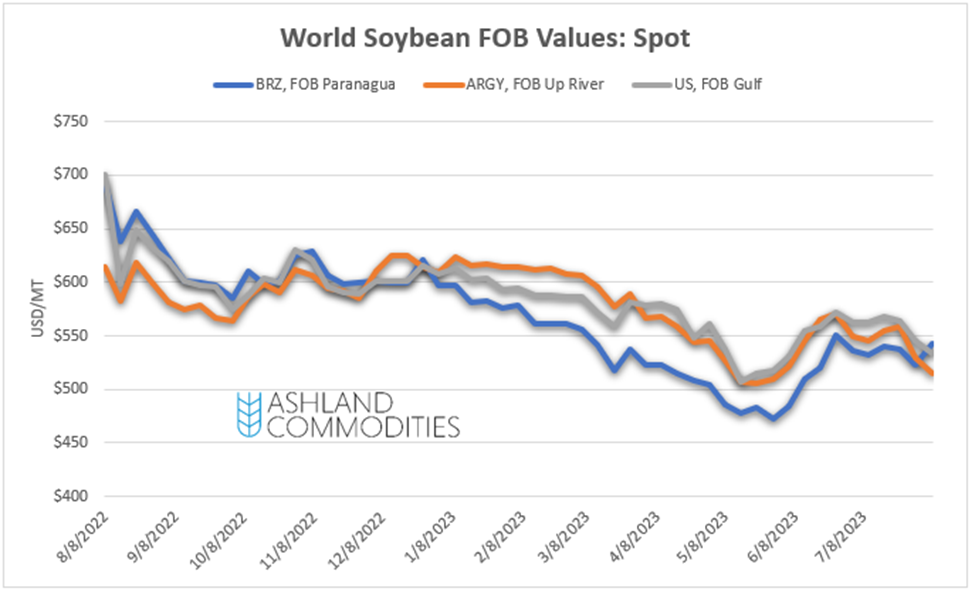

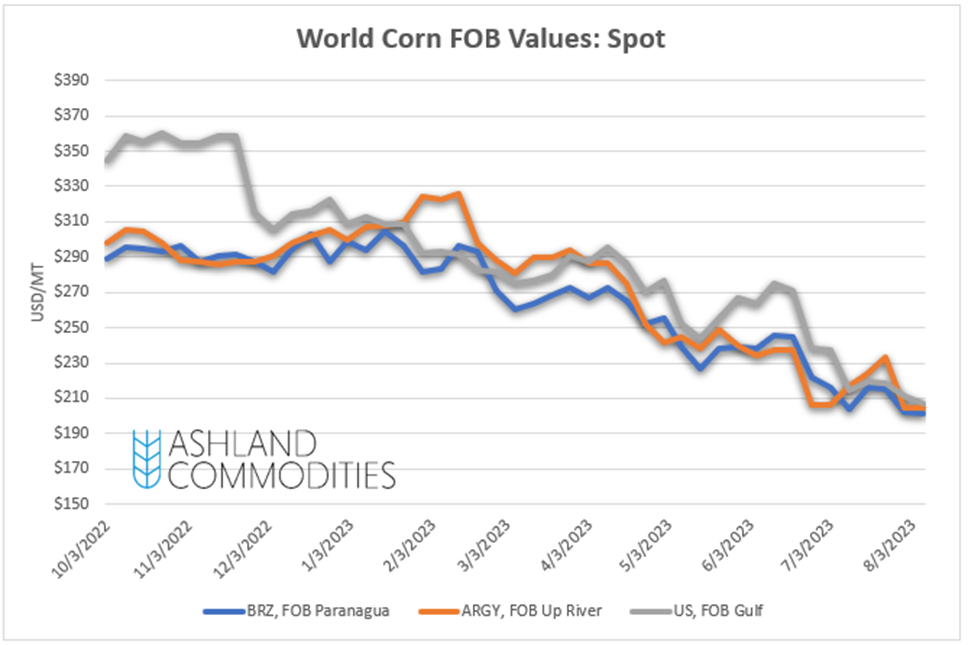

- I expect that the market will begin to pay more and more attention to the US vs Brazil bean price relationship. With Brazil’s very large corn crop, they have put a priority on corn exports, which makes the US the cheapest soybean in the world. Again, as I mentioned above, the US does not need to have a significant soybean export program this year.

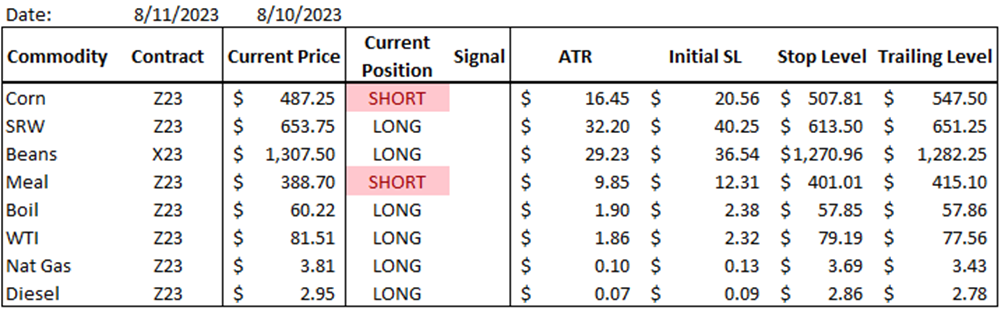

Trend Models & Positioning:

Below is a summary of the current trend model positioning and any weekly changes that were made. As a quick reminder, these trend models are a combination of long term and short-term moving averages that take momentum and volatility inputs into consideration as well.

There has been no major week-over-week change in my trend models. I remain short corn and soybean meal and long everything else.

I mentioned last week that my model had shown a short SRW signal on Friday and that I was likely to short SRW in the spirit of not fading my model. Well, ultimately decided to fade my model due to support resistance in the area. Was it a good decision? I don’t know. The signal was very short lived as you can see (my model is now long again), but the current position would have been in the money by 20 cents…. You win some, you lose some, I guess.

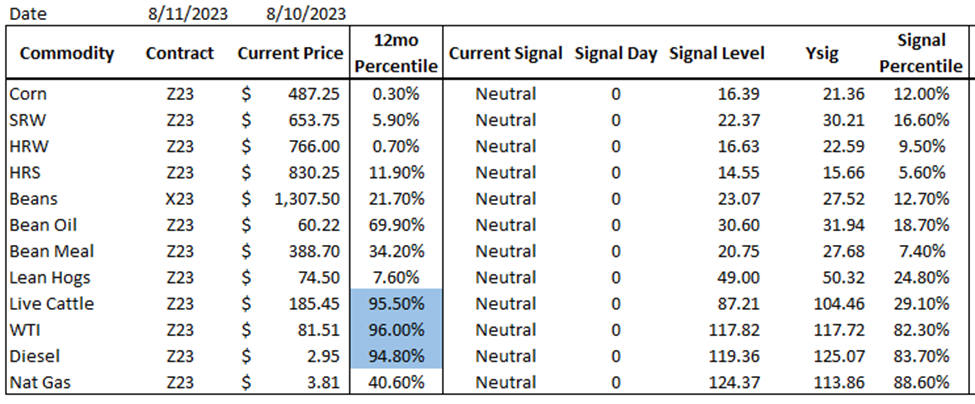

Hedge Models & Positioning:

Below is a summary of my hedge model positioning and any weekly changes that were made. As a reminder, these hedge models are trend reversals model that I have built over the last few years. When back tested on 40 years of corn futures (using one example) if you were a vertically integrated processor buying and selling corn futures, you would have sold your bushels in the 78th percentile and bought your bushels in the 15th percentile.

Similarly, my hedge models are currently neutral in all markets. This makes sense though as the signals here tend to be 1-2 days in duration. This week, I did get quite a few buy signals. The signal summary is below:

- Buy CZ23 corn at $4.96/bu

- Buy SX23 beans at $10.06/bu

- Buy KWZ23 HRW at $7.79/bu

- Buy MWZ23 HRS at $8.40/bu

I also got one sell signal on the week:

- Sell HOZ23 Diesel at $2.97/gal

Regarding my weekly hedge positioning, I extended coverage on the consumer side by buying soybean oil and extended a little bit of coverage into crop year 24/25 by adding some option positions on the producer side. I know, I know, why would I be adding producer coverage when my hedge model is giving buy signals on those same commodities? The reality is that I would have liked to extend hedge coverage a few months back, but didn’t start this hedging exercise until 8/4/23, so I am slightly behind the hypothetical Eightball – these sales are more catch-up sales using optionality in my mind. If prices improve, I very well may roll out of the options into futures. If not, I’ve got some coverage on in 24/25. Below is a summary of my hedging activity this week:

- Consumer activity:

- Buy 25% of Q1 ’24 soybean oil at $57.50 using futures

- Buy 25% of Q2 ’24 soybean oil at $57.00 using futures

- Producer Activity:

- Sell 20% of expected soybean production in SX24 using 1200/1440 collar for 28 cents

- Sell 20% of expected corn production in CZ24 using 500/600 collar for 18 cents

- Sell 20% of expected wheat production in KN24 using 760/840 collar for 19 cents

If you want to see my full hedge model positioning, please CLICK HERE.

Something to Think About:

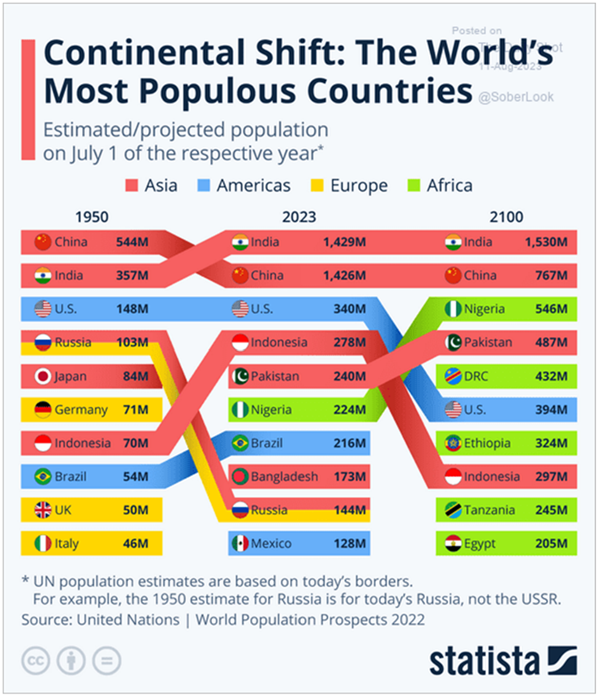

By the year 2100, the Chinese population will be about 50% of what it is today. Additionally, African countries will begin moving up the population list. How does this change global grain flows?

Charts:

Enjoy what you’re reading? Sign up for our free weekly newsletter to have posts like this delivered straight to your inbox each weekend.