Quote of the week: “Take the risk or lose the chance.”

Fact of the week: Termite queens live longer than any insect. Some scientists estimate that they can live as long as 100 years.

Last Week:

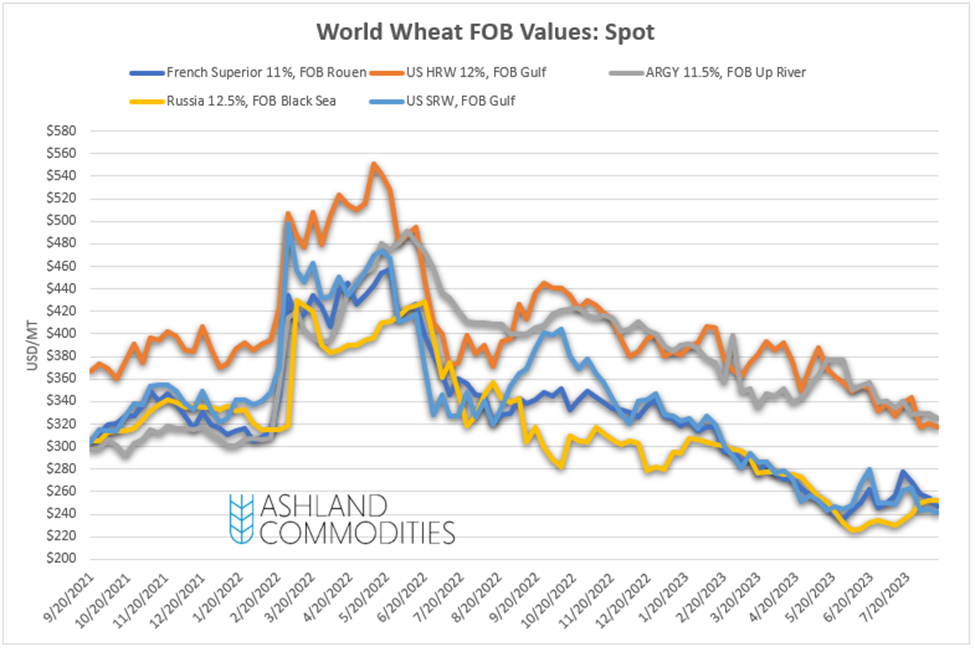

- Russia continues to bomb Ukraine on a regular basis. These bombings tend to get a lot more attention over the weekends than they do during the week. In any event, the half life of these bombings continues to shorten. To me, the risk still exists of a material escalation that causes higher prices, but that risk is reducing every day. The world can live with, or without, grain exports from Ukraine via the Black Sea and the Danube. The world cannot live without grain exports from Russia out of the Black Sea. Remember that.

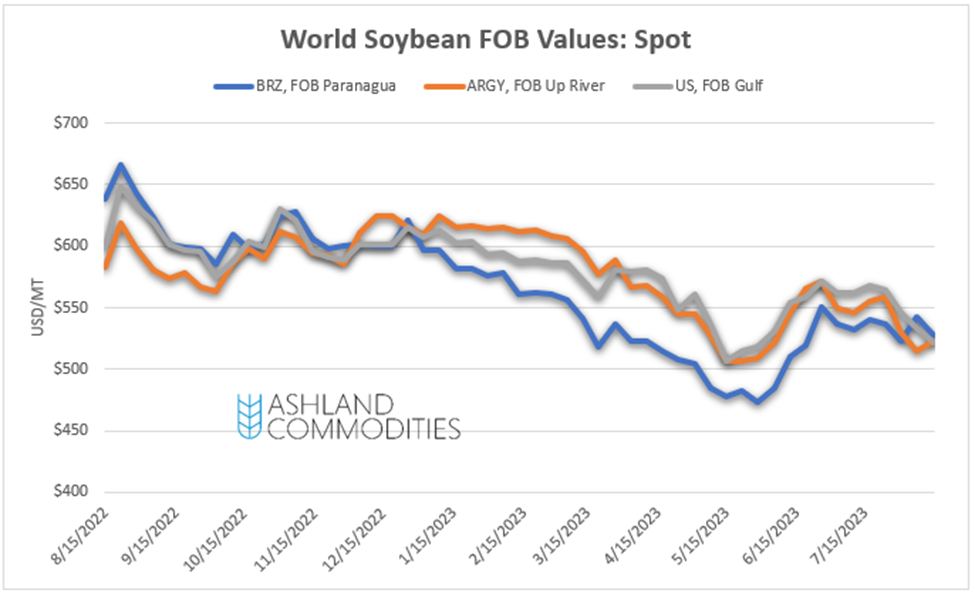

- There were more export sales flashes of soybeans to China this week. This time 416k mt. China buying US beans, especially at these levels, tells you a few things. 1. Brazil is exporting more corn than soybeans at the moment. 2. China is managing the risk of something by buying $13- and $14-dollar US beans (more on this below).

- On the week for the 23/24 crop year, Corn export sales were 794k mt, wheat were 359k mt, and soybeans were 1.4m mt. Of the 1.4M mt of export sales to China, about 70% went to China.

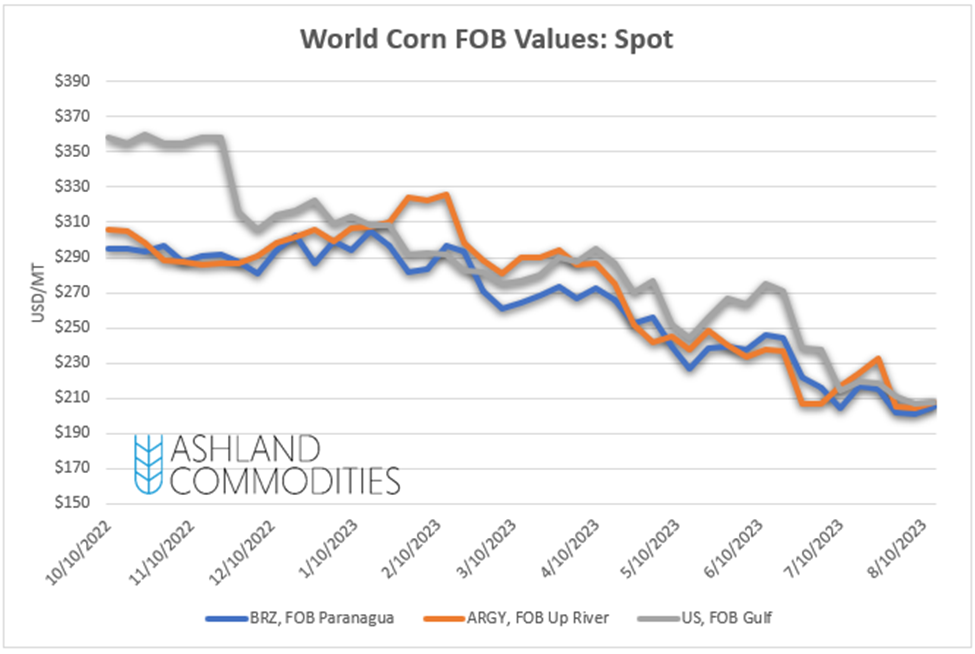

- Related to corn and wheat export sales: questioning the data provides an interesting insight. Look at the largest buyers for both. Mexico, Nicaragua, Honduras, Jamaica, South Korea. What do all those countries have in common? They’re captive buyers. What this tells me is that we are still struggling to price into the true marginal buyer’s ports. If we want that to price into the marginal buyer’s ports, we likely need our prices to go lower.

- China’s key northern grain belt has seen flooding again in a big way this year (remember 2020). Rumors are that the flooding reduced corn production by about 2%, or 4-5mmt. The floods also impacted rice production. Rumors on rice are that the production will fall by 3-5%. If this materializes to become something bigger, and China needs to step up their exports it could impact global prices. Sure, Brazil has a very large crop this year, so they will be able to pick up some of the slack (so it’s not quite like 2020), but I don’t believe this to be priced into the market today.

- Retail inflation in India for July was released this week at 7.4% YoY. The cause, surging food prices. Shortly after this news was announced, it was announced that India was going to attempt to buy Russian wheat at a discount to their local prices to cool food inflation.

- As if it wasn’t already bad enough for the corn bulls, the FSA acres tend to agree with corn acres moving higher than the 94.1M in the WASDE.

- NOPA crush was out this week with 173.3m bushels of bean crushed vs 171.3m estimated.

- Heat dome. Heat dome. Heat dome. That’s been all the talk this week. Really hot, dry, temps are moving their way into the Midwest next week with weather forecasts showing places like Des Moines, Iowa topping out at 103 degrees on Wednesday and 101 degrees on Thursday.

- Ethanol margins are narrowing. This week both ethanol production and inventories were up while weekly implied gasoline demand was down. Implied gas demand was down likely because of higher prices. In any event, this doesn’t bode well for longer term ethanol margins and production.

Want this delivered straight to your email every weekend for free? Sign up below.

Next Week:

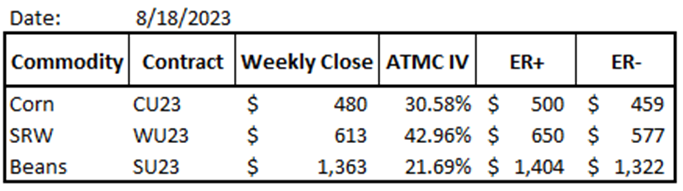

Above are the expected ranges for the upcoming week. ER+ means that if market momentum is higher, we are likely to achieve that price target. ER- means that if market momentum is lower, we are likely to achieve that target. (basically, at least, that’s the easiest way to describe it)

- Keep an eye on the Pro Farmer Tour – it starts next week. My expectation is that you will hear about the crop variability from region to region due to how things started, but overall that corn is not as bad as initially feared. Beans on the other hand – I’ve had quite a few people send me pictures of bean fields that look great and then talk about the small pods, etc. . Keep an eye on this.

- I will be keeping a very close eye on the heat dome in the Midwest this week. It is coming at a pretty bad time in soybean development, although the market has already put some risk premium in bean prices to account for this, it is still worth keeping a close eye on.

- Chinese exports. As I mentioned above, China has been buying US soybeans recently. There are concerns that the monsoons over there have caused broader issues with their crops, so I will be keeping a very close eye out for any additional exports.

- Watch the Ukraine “humanitarian corridor” for grain. The first ship left Odessa this week through the corridor. While it might not be a game changer for grain exports, it may have impacts down the road related to the war.

- The world economy appears to be on shaky footing. There is potential spillover from the real estate crisis in China. There are several European countries either in or about to enter a recession. All of this could impact forward demand estimates for various energy and agricultural products.

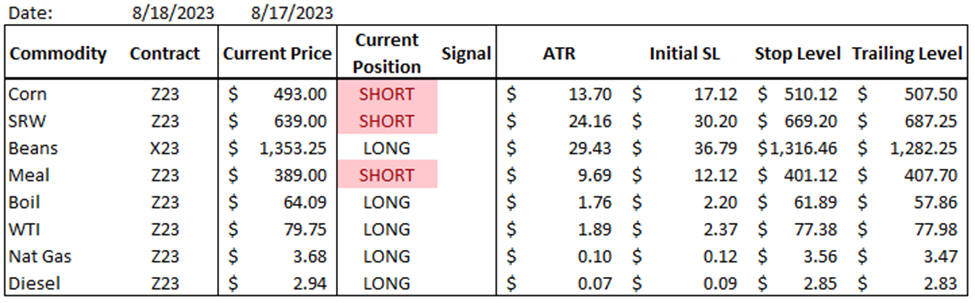

Trend/Spec Models & Positioning:

Below is a summary of my primary trend model positioning, any weekly changes that were made, and any other spec related longer-term positions that I have on. I occasionally will trade into and out of positions during the week. Those are not reflected here because in those instances I could just pick highs and lows on a chart and never lose. The purpose of this is to show the longer-term trades and to watch them run their course.

The only adjustment to my trend models this week was a short signal on SRW wheat. As I mentioned last week, I was given another signal recently and overruled it because of trend lines in the area…. I am still kicking myself over that by the way. If I had followed the model originally, I would have shorted SRW at $673 vs the current market of $615 (at the time of writing). This time I took the trade. I am currently short SRW from $624 and under water…. We will see if it turns around or if I get stopped out.

Other notable positions:

- Short Dec corn from $507

- Short Dec meal from $398.5

- Long Dec crude oil from $71.25

- Long Dec diesel at $2.37

In another trade, I am long the CK24-WK24 spread from $156. This seasonal spread has a great tendency to rise going out of harvest and has produced a profit in 14 of the last 15 years.

Want this delivered straight to your email every weekend for free? Sign up below.

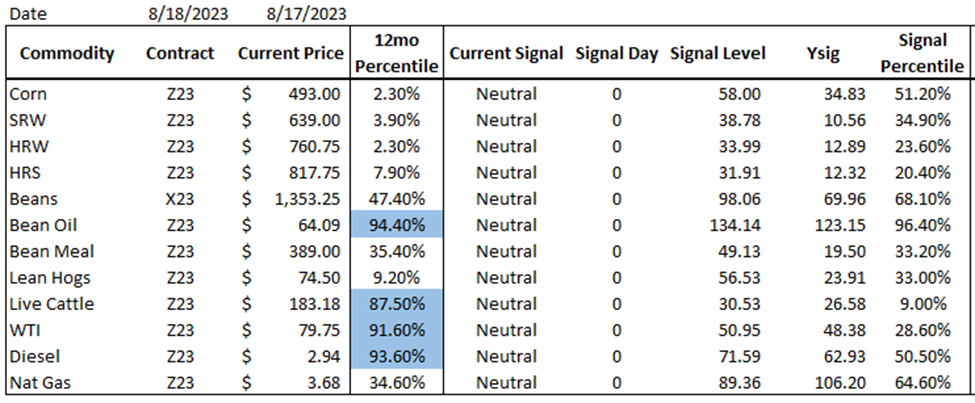

Hedge Models & Positioning:

Below is a summary of my hedge model positioning and any weekly changes that were made. As a reminder, these hedge models are trend reversals model that I have built over the last few years.

During the week, I had several hedge model buy alerts. Below is a summary of the alerts and the coverage adjustments that I made.

- Buy Dec corn at $481

- Buy Dec meal at $381.5

- Buy Dec HRW at $752

- Buy Dec HRS at $806

- Buy Dec Hogs at $71.18

For the hypothetical feed mill, this week I:

- Bought 25% of Q1 corn needs at $490 (CH24 futures). This brings my total Q1 coverage up to 75%. I have 50% covered with a 520/570 call spread and 25% in futures at this point. Do I think that harvest lows are in? No, but I think we are approaching levels that would signify harvest lows, so it’s a good idea to start extending something. Hedging is not about picking tops and bottoms; it’s executing and adjusting smart coverage.

- Bought 25% of Q2 corn needs at $502 (CN24 futures). This brings my total Q2 coverage up to 55%. I have 25% on in futures and another 30% on in a 530/580 call spread.

- Bought 50% of Q1 meal needs (SMH24 futures) at $371. This is the only Q1 meal position I have on.

- Bought 25% of Q2 meal needs (SMN24 futures) at 370. This is the only Q2 meal position I have on.

Want to know all of the current hedge positions? CLICK HERE

Something to Think About:

Something I’ve been thinking about more and more is – when do grains find their demand floor? What I mean by demand floor, is at what point do we begin to pick up exports that are more than just the captive buyers in the market? Consider the locations that we exported corn and wheat to this week:

Mexico (captive), South Korea (captive), Jamaica (captive), Colombia, Honduras, etc. etc. etc.

All these countries have one or two things in common. They are either relatively close to the US geographically, or we provide them with some sort of support. With the droughts and low stock environment that we have faced the past few years, combined with large crops overseas, it’s been a while since we have had a material corn and wheat export program. Truthfully, I am skeptical that we get there this year on wheat due to continued tight stocks, but it is possible on corn. When I was penciling the numbers earlier this week the conclusion that I came to was that corn futures would need to be below $4.50/bu to pencil into China (depending on a number of variables).

Charts:

December Corn: 4 hour

December Wheat: 4 hour

November Beans: 4 hour

Note: nothing in this post constitutes a buy or sell offer. All information is meant for educational use and is simply used to display various hedging and risk management techniques. If you are interested in trading and or hedging with derivative products, please carefuly consider the risks and consult a registered professional.