Quote of the week: “A positive attitude is a magnet for positive results.”

Fact of the week: At birth a baby panda is smaller than a mouse.

Last Week:

- Markets gapped higher on Sunday night over the Heat Dome weather forecast but all had closed the gaps by the close that day. It’s a really tough time of year for the markets to sustain a rally. Even in years with significant drought issues, markets come off their highs going into harvest. Is the weather having an impact? Probably (IMO), but we wont know the extent of that impact until the combines are rolling and that likely leads to rangebound and corn and wheat markets. I could see a case for bullish

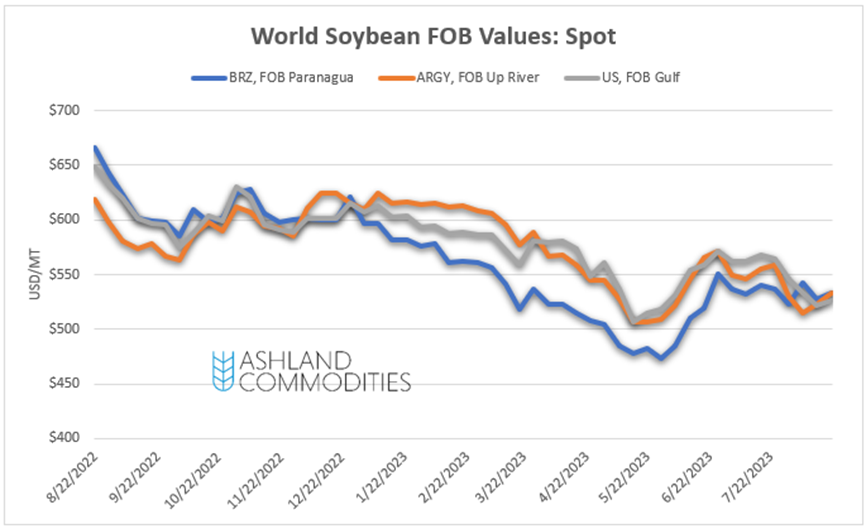

- If you’re on Twitter (X, whatever they call it these days), you know it’s ProFarmer week. Everyone’s feed has been slammed with pictures of corn and trying to anticipate what it means for yield. Personally, I haven’t seen much that would drastically change the USDA forecast. I try not to speculate on yield, because what do I know, but I’m going to today (lucky you!) my personal feelings are that the USDA is probably close to the market on corn, although there may be a slightly downward bias due to the heat during grain fill. Beans, on the other hand, may be a bit too high which is concerning. With the really hot/dry weather impacting beans at a time when they are trying to fill pods, you could end up seeing smaller pods and smaller beans which would bring down the yield and TW. I’m not lobbying for a 45bu yield or anything, but maybe we see another .5 – 1.5bu reduction on beans…. The question from there becomes, can we afford ~49bu yield without some sort of demand rationing?

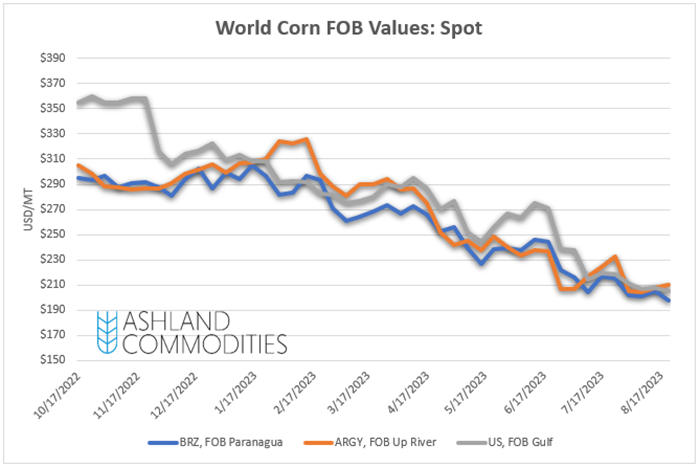

- Mexico continues to buy a lot of US corn. Interesting for a country that is also trying to ban imports of US GMO corn, but that’s neither here nor there. If you look at the weekly US corn export sales data, you will see that Mexico represented about 50% of the sales this week… without them we would have an even bigger problem that we already do. I’ve said it once and I’ll say it again, for corn to sustain a rally, we really need some marginal demand that we don’t have today.

- The head of the Russian paramilitary group, the Wagoner group, was killed in a plane crash this week. Surprise? Not really, he had his day coming after leading his troops towards Moscow. It is interesting to think about what impact this could have on the war. According to the media, most of the gains that Russia has experienced in recent weeks have come from the Wagoner group. What happens now?

- Despite the bean market showing strength, the X-H spread reached contract lows towards the end of the week at ~16 cents. In fact, the Z-H spreads on corn and wheat are also at contract lows. Not exactly a bullish sign.

Next Week:

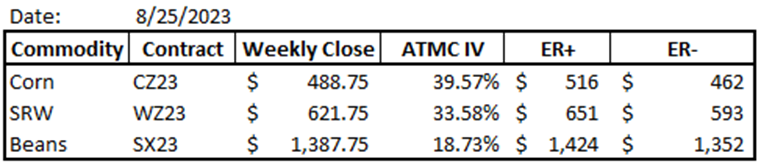

Above are the expected ranges for the upcoming week. ER+ means that if market momentum is higher, we are likely to achieve that price target. ER- means that if market momentum is lower, we are likely to achieve that target. Any move outside of either range would be considered an “outside” week.

- I’ll be keeping a very close eye on the weather again next week. The variability this growing season has been quite large, and we are not ending the growing season on a high note. If ProFarmer taught us anything, it’s that there will be large differences in quality/yield from county to county and state to state.

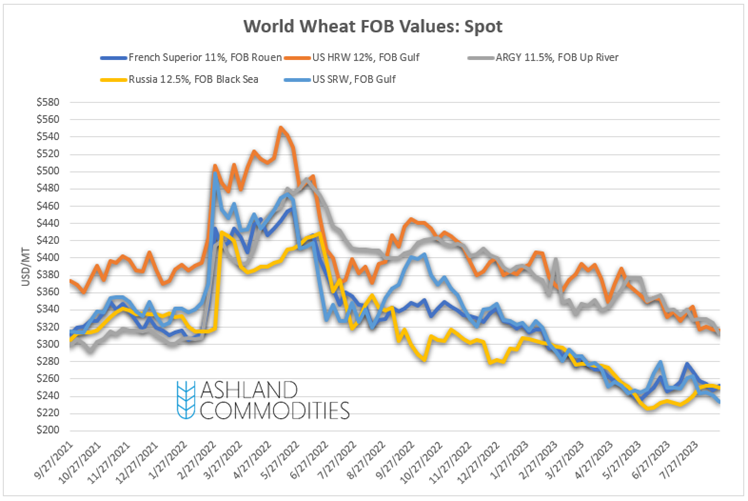

- Keep an eye on Argentina and their wheat growing conditions. It’s not been talked about much, but currently their wheat is 20% good to excellent vs 19% last year. The only difference is that the USDA is forecasting a ~30% increase in yield YoY.

- China has been buying US soybeans in recent weeks but backed away from the market this week. With the tight US soybean situation, and significant unexpected exports could cause the market to rally. On a similar note, I keep hearing rumors about Chinese grain production being worse than expected due to the flooding. DTN had the Dalian exchange bean trading at $18.77 this week and their crush margins have been good. Forward demand remains a question due to the softness in their economy.

- Speaking of the Chinese economy, keep an eye on how the real estate issues spill over into other markets. Right now, the issues appear to be contained in China, but as the worlds second largest economy, things could spill over.

- There are a couple of different things going on with Russia/Ukraine that will be interesting to watch. The first is how Russia preforms without the head of the Wagoner group. The second is the humanitarian corridor that Ukraine set up to allow grain ships to exit.

- Keep a really, really, close eye on riverway basis levels going forward. It’s been well publicized that the water levels on the Mississippi river have been dropping and that barge freight has been increasing in response to the lower water levels. If this continues, you could see basis come off to compensate.

Want this delivered straight to your email every weekend for free? Sign up below.

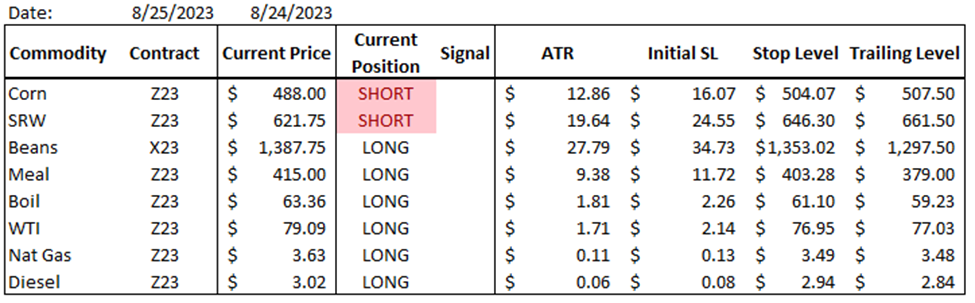

Trend/Spec Models & Positioning:

Below is a summary of my primary trend model positioning, any weekly changes that were made, and any other spec related longer-term positions that I have on. I occasionally will trade into and out of positions during the week. Those are not reflected here. The purpose of this is to show the longer-term trades and to watch them run their course.

The trend models made a few adjustments this week:

- I “buyer exited” my soybean meal short on Monday. When I buyer exit it means that I have seen something I don’t like, and I am overriding my model to exit the position – I try hard not to do this. Ultimately, I am glad I did though. I ended up getting out for a very small profit when I would have lost money had I waited until my stop hit.

- I was stopped out of WTI crude at $77.98 on 8/23. Total profit of $6.73/bbl for the position.

- My model went long soybean meal on 8/24/23, so I bought at the close. I am now long from $412. Not sure how I feel about this position, but I took it.

Previously Mentioned Positions:

- Short Dec corn at $507

- Long Dec diesel at $2.37

- Short SRW $624

- Long the CK24-WK24 spread from -$156.

Hedge Models & Positioning:

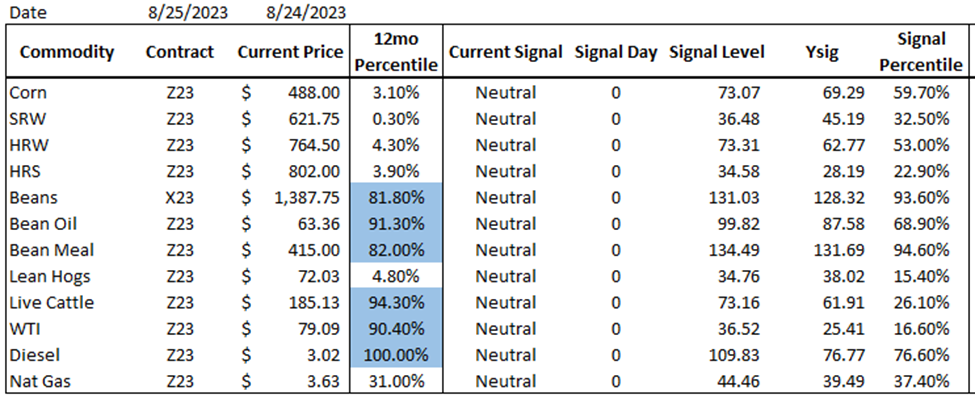

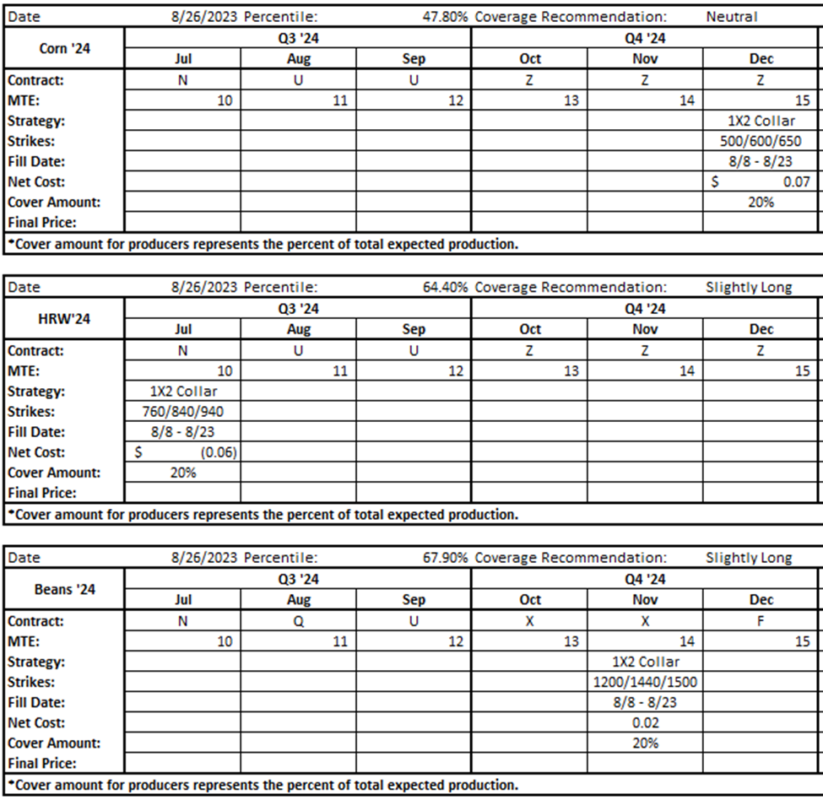

Below is a summary of my hedge model positioning and any weekly changes that were made. In addition to this, I have also created charts below that show the detailed coverage I have on. As a reminder, my hedge model is a trend reversal model that signals significantly overbought and oversold conditions in the intermediate timeframe. These models typically produce 5-10 buy/sell signals per contract annually.

Coverage Adjustments:

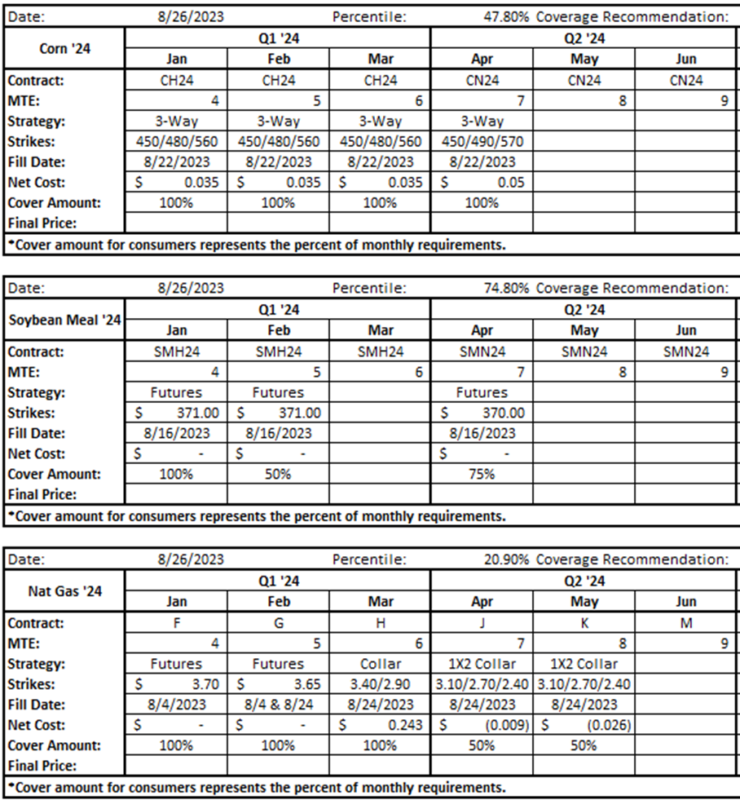

With the gyrations in the market this week I made quite a few hedge changes and improvements. To start with the changes on the consumer side, I:

- Rolled out of the call spreads that I had in Q1 and Q2 on the rally Monday. This allowed me to exit the protection that had run its course and optimize the position cost effectively.

- I also sold the futures for Q1 and Q2 that I had bought last week on Monday, lifting those hedges. Over about a 3-day period I was able to make 20 cents and thought the market was overvalued, so I took my money and used it to average into another options strategy.

- Since at that point I had lifted all of the corn coverage I had on, I then began replacing coverage with 3-ways. I added 450/480/560 3-ways that cover 100% of Q1 and also added a 450/490/570 3-Way to cover my April requirements. With all the puts and takes between the positions, these 3-ways cost ~4 cents. (details below)

- In addition to this, I layered in some additional Natural Gas futures to finish off Q1 and put on 1X2 collars for 50% of my April and May volumes.

On the producer side:

- Again, during the rally on Monday, I took the opportunity to covert some collars that into 1X2 positions for 2024 production. If you’re not familiar, a 1X2 is a collar that has two short calls instead of one. It creates a “double up” scenario, but also allows you to significantly reduce the premium you would pay and gives you flexibility because you don’t end up with a “floor below the floor” like you would on a 3-way. In this case, I sold calls that were above my previous calls, and are at levels that I would be more than happy selling at if prices went there. To summarize, I:

- Sold CZ24 650 calls to convert a 500/600 collar into a 500/600/650 1X2

- Sold KWN24 940 calls to convert a 760/840 collar into a 760/840/940 1X2

- Sold SX24 1500 calls to convert a 1200/1440 collar into a 1200/1440/1500 1X2

I have also updated the way that I will show my hedge positioning. With the active management approach that I like to take, it was becoming difficult to concisely show what had happened. Going forward I will be including the tables below that show my coverage.

Want to know all of the current hedge positions? CLICK HERE

Hedge Coverage:

Consumer Coverage:

Producer Coverage:

Want this delivered straight to your email every weekend for free? Sign up below.

Charts:

December Corn: 4 hour

Corn remains in a technical downtrend although the short-term trend is rangebound. The bears need a break below 473 to resume the broader downtrend and the bulls need a break above 508 to have a shot at starting and uptrend. Seasonally, this is a very difficult time for the corn market to rally, so while I think the bias is higher, I would be hesitant to build into a long position from here.

December Wheat: 4 hour

Like corn, the broader trend on wheat remains down, but we are short term rangebound. The bears are looking to break below 612 to resume the downtrend and the bulls are looking for a break above 646 to begin some sort of uptrend. US HRS remains the cheapest wheat in the world, so our downside could be limited. At the same time, if corn wants to resume the broader downtrend it could pull wheat along with it.

November Beans: 4 hour

Beans remain in a technical uptrend. On Friday the bean market took out Monday’s high, confirming that uptrend is still intact. The next target for the bulls should be $1400 and then the $1430 area. To resume any type of downtrend, the market needs to start by breaking below the successively higher trend lines that have been established.

Note: nothing in this post constitutes a buy or sell offer. All information is meant for educational use and is simply used to display various hedging and risk management techniques. If you are interested in trading and or hedging with derivative products, please carefuly consider the risks and consult a registered professional.