Welcome to the inaugural Ashland Commodities Weekly Recap! Through the years I have received market wires thousands of times from hundreds of people. Generally, they lack substance and simply regurgitate information. That is not what I plan to do.

I plan to share a recap of market events, but to also share details around my thoughts, opinions, and positions related to those market events. Simply put – this will be a market recap that shares the weeks events and data, but does so in a fun way, and shares trades that go along with that information.

Let’s get started!

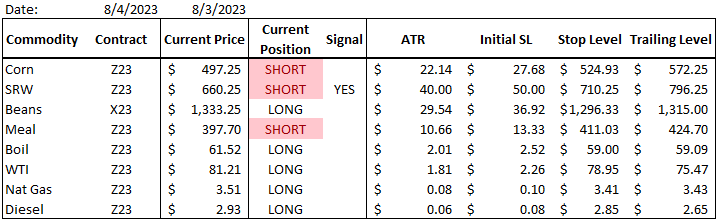

Trend Models:

Below is a summary of the current trend model positioning and any weekly changes that were made. As a quick reminder, these trend models are a combination of long term and short-term moving averages that take momentum and volatility inputs into consideration as well.

As of the close on Friday, my model is still short corn and soybean meal and just gave a signal to go short SRW wheat. The model is long every other market that I track with it. With that, I will likely be working a short position on SRW at the open. I know, it sounds ridiculous with what’s going on geopolitically, but I try to take my emotions out of this model and trade what it tells me to trade. Afterall, my model does have a positive return expectancy over the long run.

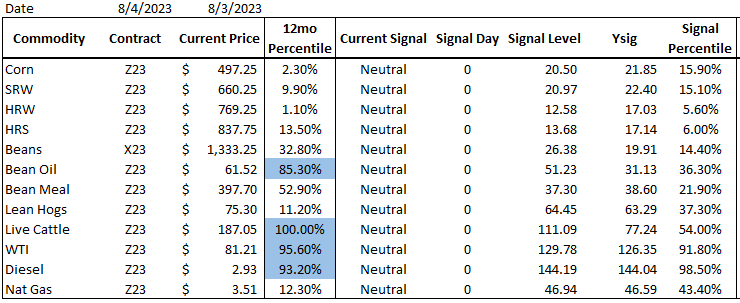

Hedge Models:

Below is a summary of my hedge model positioning and any weekly changes that were made. As a reminder, these hedge models are trend reversals model that I have built over the last few years. When back tested on 40 years of corn futures (using one example) if you were a vertically integrated processor buying and selling corn futures, you would have sold your bushels in the 78th percentile and bought your bushels in the 15th percentile…. This model works.

My hedge models are very close to giving buy reversal signals on corn, SRW, HRW, HRS, and soybeans. with that being said, I took the liberty to extend coverage on the food processing side this week. I usually try not to front run my models, but with all of the geopolitical risk in the markets these days, I thought it made sense to add a bit of coverage ahead of the weekend. to summmarize:

- Bought some Q1 ’24 corn using call spreads

- Bought some Q2 ’24 corn using call spreads

- Bought some Q1 ’24 SRW using collars

- Bought some Q2 ’24 SRW using collars

- Bought some Q1 ’24 nat gas using futures

For a full breakdown of my weekly purchases, please see my regularly update post on the Hypothetical Hedging.

Positioning:

Speculatively:

Speculatively, I went into the weekend flat. I am bearish corn, neutral wheat, and neutral beans at this point and will be looking for an opportunity to short corn either with futures or long put options for shorter tern trades in the upcoming week.

Hedging:

As mentioned above, I did take some corn, SRW, and natural gas coverage this week on the long side. After a selloff like we have seen over the last 5-10 days, it’s really really hard not to add something. My thought process around the coverage was to cover corn using call spreads as that is where I am most bearish (i.e. large production coming). I also covered wheat using collars. The wheat market is being subjected to crazy geopolitical risk with the ongoing war in Ukraine, which makes absolute upside protection warranted, but I do want some downside because of the very large

Charts:

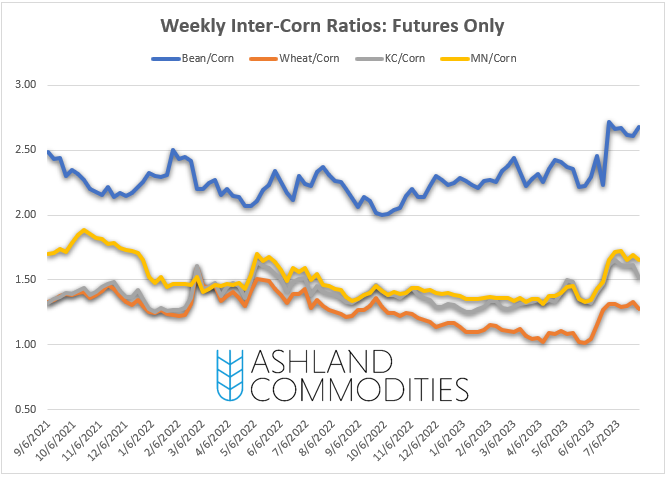

Corn remains towards the lower end of the trend channel up against the $4.80/$4.85 support level. Longer term, my belief is that this level will break, but in the short term the market is oversold.

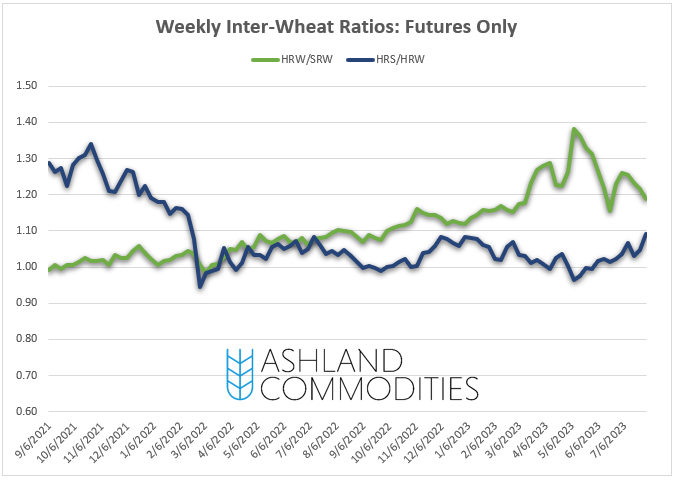

Wheat is at a very interesting point. Technically, still in an uptrend (with a massive double top, as I mentioned on Twitter). My bias for wheat is neutral to higher at this point.

Beans are the outlier. They are still holding firm at higher levels, even after the massive selloff in grains throughout the week. With decent levels of support around the 200dma and the historic $13.60 support, I could see a choppy trade for the next week or two.

Want this delivered straight to your inbox every weekend? Sign up for the newsletter below.